Monthly Property News 7th Edition 2022

Are we at a peak now as the downturn builds a little momentum over June

Hi Guys, it’s Dean O’Brien from OBrien Real Estate with the seventh edition of the monthly property news for 2022 where real estate information is on the house.

The Australian Government released its first findings of its data releases from the Census we had in August 2021. There are some key findings so far from the census from real estate perspective, the first being the huge number of un-occupied properties across Australia, this no doubt impacts on prices paid by buyers and renters as there is a shortage of properties due to owners choosing to keep properties vacant. The second finding that relates to real estate is the increasing trend of single parent families and how this is places pressure on housing but also the cost of living having one income source. To review the findings visit the ABS website https://www.abs.gov.au/statistics/people/people-and-communities/snapshot-australia/2021

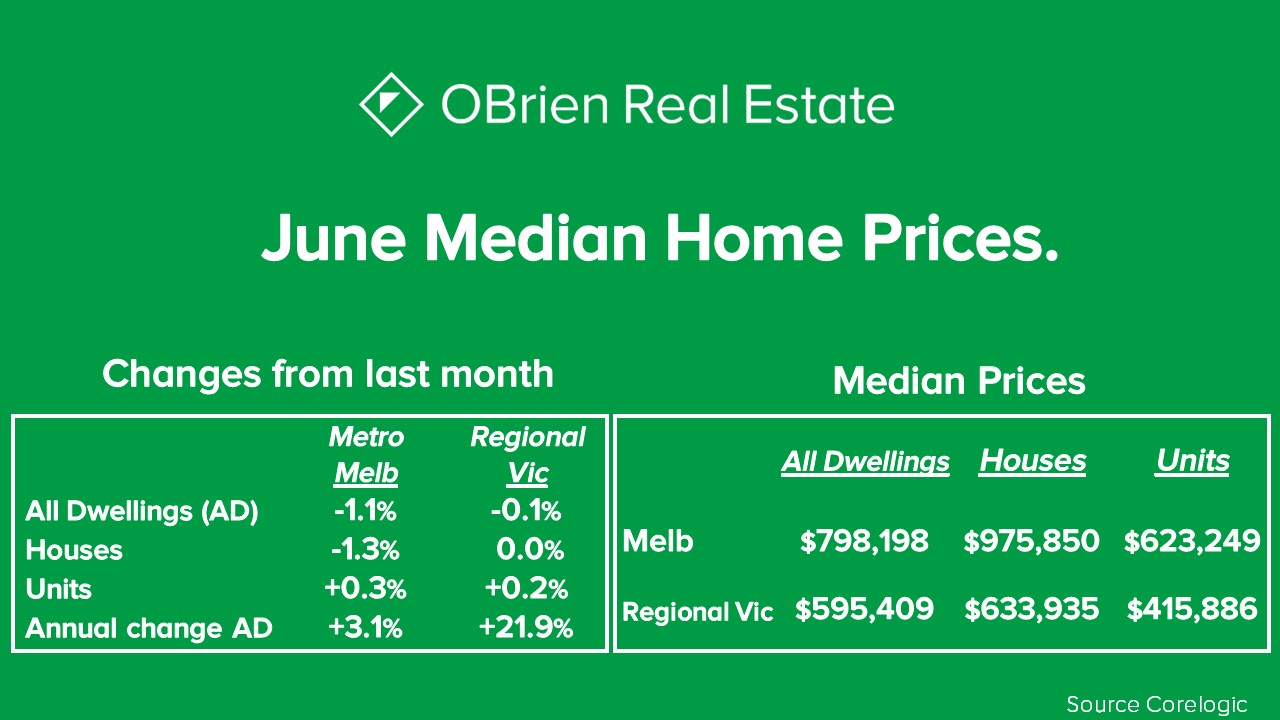

Corelogic released its June Home Value Index (insert graph) and Nationally prices for all dwellings were down 0.6% with Sydney falling the most with a 1.6% drop and Melbourne a 1.1% drops. Melburnians now have a median home price below $800,000 for both units and houses, sitting at just over $798,000. Unit prices again, as we saw last month are holding their value more than houses, falling 0.6% compared to 1.3%. The pullback on prices so far this year has been small, particularly when you consider the ASX has fallen 18%. Prices as we know across the food industry, building industry and energy industry have all spiked due to supply chain issues and we also are seeing how supply affects pricing in real estate too. For example Melbourne and Sydney still remain 8% and 7% above 2021 stock levels whereas Adelaide and Brisbane which have all dramatically increased in price over the last 12 months are sitting at 16.9% and 14.9% down on stock levels. In Regional Victoria, we saw our first drop back in prices since before June 2020, with a 0.1% decline for combined dwelling which places the medium home price a little over $595,000

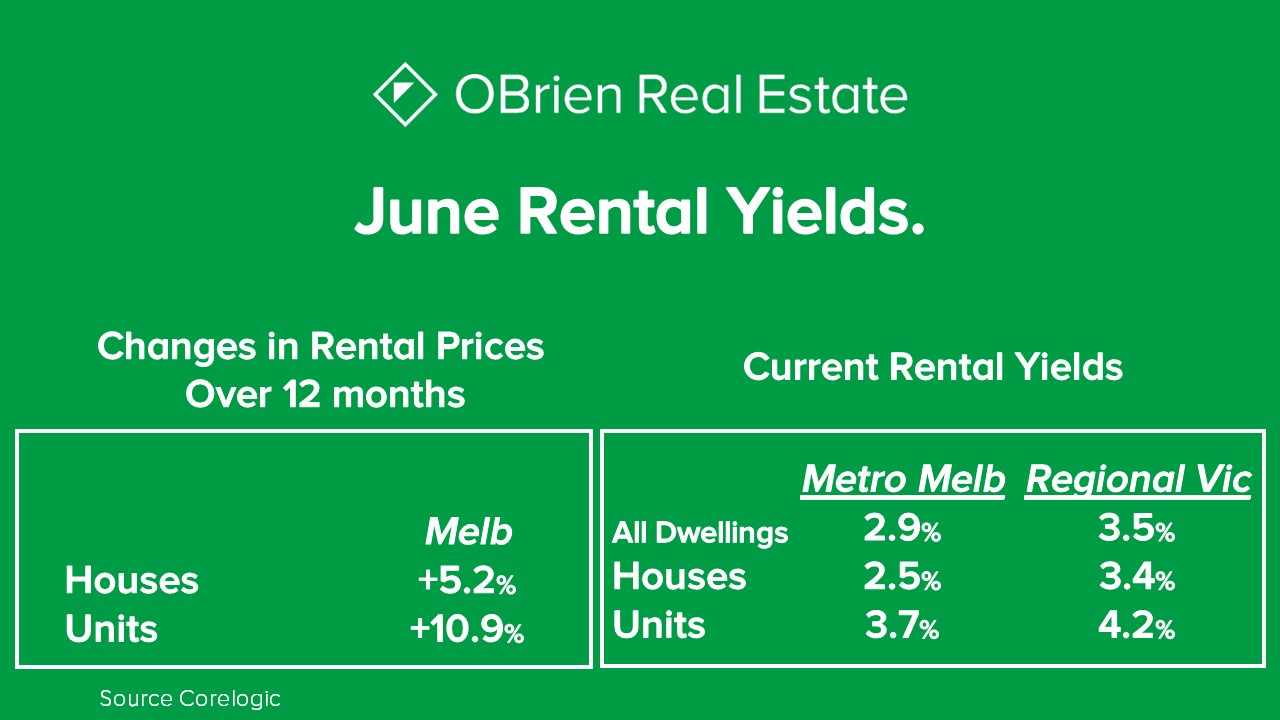

Looking at the rental market, rents Nationally ended the financial year at 9.5% above the previous 12 months. We certainly do have a very tight rental market and rents in Melbourne from a unit perspective is leading all capital cities in price growth with a 10.9% increase in rents. Homes in Melbourne are quite different though with only a 5.2% increase, we believe this lacklustre performance has been caused partly by the Residential Tenancy Act changes introduced in March 2021, but we believe rents will now increase more, due to rental providers now meeting the minimum standards criteria for a rental property.

And lastly for this month’s edition, the question will need to ask ourselves if we are sellers in the market, is are we at the peak right now because what might be over the horizon is more interest rate increases and not just in July but with financial commentators predicting another rise in August, it could be a question worth pondering.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this month, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.