Weekly Property News 11th Edition 2021

“Largest increase in home prices in 32 years”

Hi Guys, it’s Dean O’Brien from OBrien Real Estate with the 11th edition of the Property News for 2021 where real estate information is on the house.

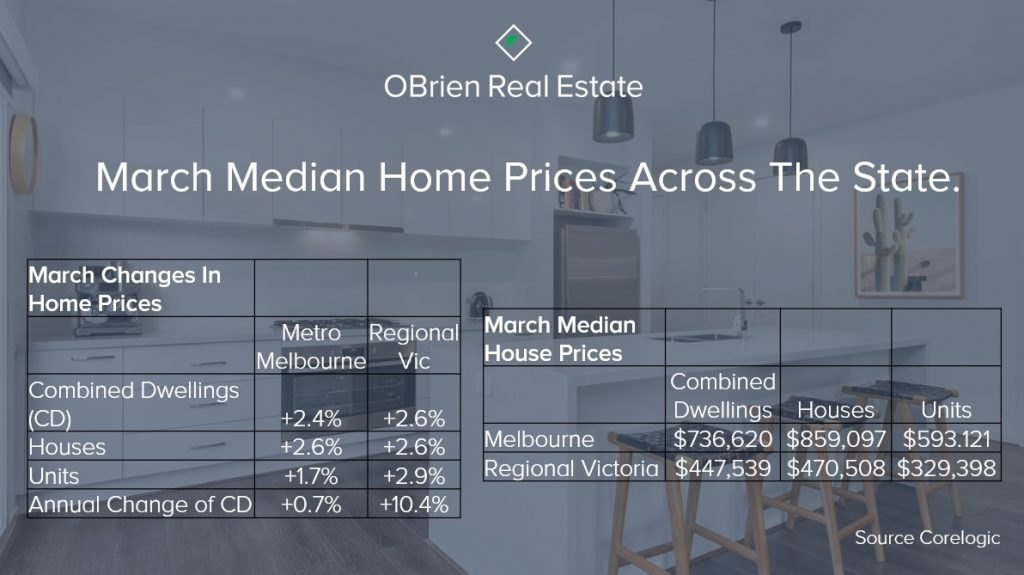

Corelogic released it’s Home Price Index on April 1 and across the country we experienced our it’s biggest monthly increase in prices in 32 years for the month of March. Metro Melbourne posted a solid 2.4% increase for March which caps off 5 consecutive months of home price growth, in fact the combined dwelling median price has risen $70,380 since 31 October which is an increase of $3,248 a week. Remembering the Melbourne Cup interest rate cut to just 0.10% basis point on November 3 being one of the catalysts for the growth we have had in the last 5 months. Regional Victoria again took the honours over Metro Melbourne with 2.6% growth for combined dwellings and since 31 October it’s combined median house price has risen by $50,862.

The recent price rises in Real Estate in Victoria has put some pressure on investment yields, average rental yields for Metro Melbourne have fallen from 3.1 to 2.9% since 31 October and for Regional Victoria yields have fallen from 4.5% to 4.1%. Median Rental Prices for year was also released by Corelogic with houses across the year increasing a small 0.9%, however units rental prices were down 8.2% for the year obviously being caused by no International Students, no overseas travelers and little immigration. But the good news is we know that we can fix an investor home loan for 2 years 2.29 per cent with NAB.

Total returns for real estate over the last 12 months for Regional Victoria has been 15.3% when you add the rental yield and the home price growth which is a tremendous return that any investment manager would be happy, Metro Melbourne is a stark difference we have only just turn the corner, now being up just 0.7% up over the course of the last 12 months bringing total investor returns to 3.6%. Looking at our major capital cities it worth noting that ladder positions have changed Hobart has now overtaken Brisbane in the Home Price Median stakes, Hobart is now the 4th most expensive capital city in Australia, behind Canberra.

Numbers – Let’s take a quick look at the numbers over month specifically for OBrien Real Estate. We saw 424 property sales transact with a highest sale price of $4.35 million, our days on market is sitting at 20 days and our average sale price is $934,000. Looking at property management for the month we leased 217 properties, our average letting is $535 a week in rent and our with a vacancy rate is sitting at a healthy 1.5 per cent.

The Australia Bureau of Statistics (ABS) released home lending data on April and the value of new loan commitments to specifically property investors rose by 4.5 per cent in February to a 3 year high while lending to owner-occupiers fell by 1.8 per cent. Renovation loans rose 8.3 per cent to 11-year highs of $322.4 million.

And the ABS also released job vacancy data and vacancies rose by 13.7 per cent ( consensus was 10%) with 288,700 vacancies for the three months to. All in all vacancies are up 26.8 per cent or 61,000 in February compared with a year ago with specifically Victoria up 10% in vacancies compared to a year ago.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this week, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.