Weekly Property News 31st Edition 2021

“Wouldn’t it nice to own a crystal ball”

Hi Guys, it’s Dean O’Brien from OBrien Real Estate with the 31st edition of the Property News for 2021 where real estate information is on the house. I’m a believer that money simply moves through different money markets trying to find its next piece of growth.

Today’s markets are much the same we have stock markets, bank deposits, property, government bonds, and to a lesser degree superannuation and to high-risk degree cryptocurrency. So where is the money moving to right now? Global stock markets are unscathed due to high vaccination rates occurring across the globe which is the main reason why our Aussie markets won’t see much change in the near term, in fact, US sharemarkets rose to all-time highs just on Monday and we have seen Aussie travel stocks improve as NSW vaccines hit a milestone 6M dose mark and with the impending NSW Premier is likely to announce potential easing restrictions in September later this week.

If we look at the property market, it is also strong and looks like it will remain that way with the low-interest-rate environment until at least 2024 as confirmed by the Reserve Bank. Then there are Bank Deposits and this market is interesting, about 30% of people today still believe that the bank is the best place for their money but the fact is the interest rates are lower than the inflation rate so, therefore, its safe but your wealth is locked in the reverse gear.

People’s are saving are 12.5% up and considering many purchases of cars, tv’s and home improvements have already happened we should expect real estate and stock market growth will continue to rise nicely over the next 2 to 3 years while interest rates remain as low as they are.

This week, domain.com.au reported Melbourne’s auction clearance rate at 47%, which is quite different from other outlets that declared a clearance rate in the ’90s. The difference being the way withdrawn properties are treated, of course with covid some people are deciding to postpone the auction however some outlets are then recording those as unsold properties. The reality is some may pass in and some may sell, either method is not 100% correct but in this week’s case, we only have 2 properties pass in.

The main edits this week are – Covid is now also in New Zealand having recorded 41 more cases on Tuesday, there are now 148 cases linked to the Auckland outbreak. So far 112 of the ASX 200 have reported earnings with declared dividends totalling $26.8 billion, up an amazing 93% on a year ago.

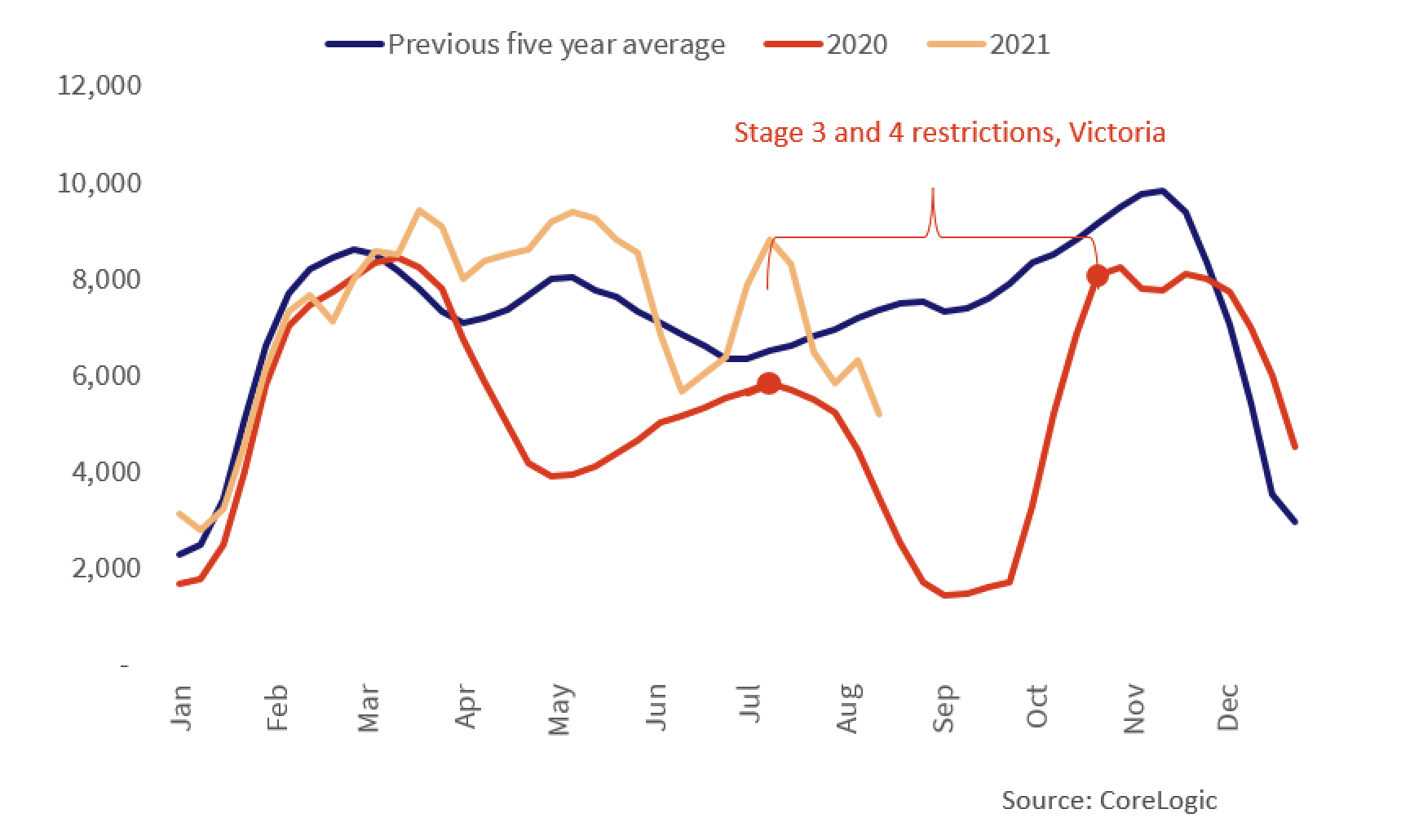

And lastly, this graph below depicts the “Dry Argument” we are having with available properties on the market, without being able to conduct one on one inspections at the moment you can understand why listings are so low, the reality will be similar to 2020 that once we open we’ll see stock levels rise and people moving on rather quickly with real estate sales and listings.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this week, I’m Dean OBrien, and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.