Monthly Property News 2nd Edition 2022

Melbourne’s Median House Price reaches $1 Million for the first time!

Hi Guys, it’s Dean OBrien from OBrien Real Estate with the second edition of the monthly property news for 2022 where real estate information is on the house.

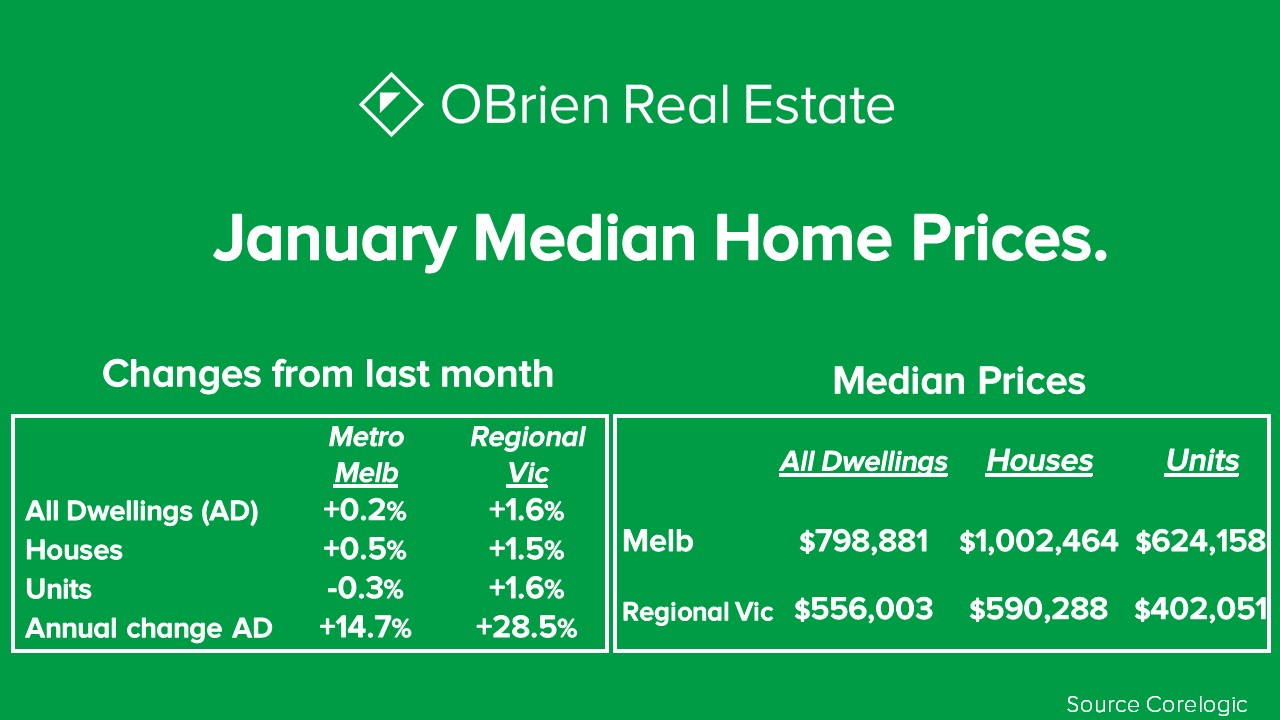

January home price data surprises the market. Since the new year there has been a lot of media reporting a reserve in 2022 on property prices, however the January data released by Corelogic on 1 February shows the National Home Price Index grew by 1.1% across the country which is an increase of 10 basis point over last month. Brisbane and Adelaide carried the national with 2.3 and 2.3% growth respectively.

Melbourne performed better than it did in December reversing a drop in home prices to record a 0.2% increase, which means Melbourne has now hit a median house price of over $1 Million for the first time. Although Melbourne for the second month in a row was the National’s worse performing capital city. The Regional Victoria market again out shone Melbourne with an overall 1.6% growth in home prices bringing the rolling 12 month growth to 23.9% whereas Melbourne has only recorded 14.9% growth.

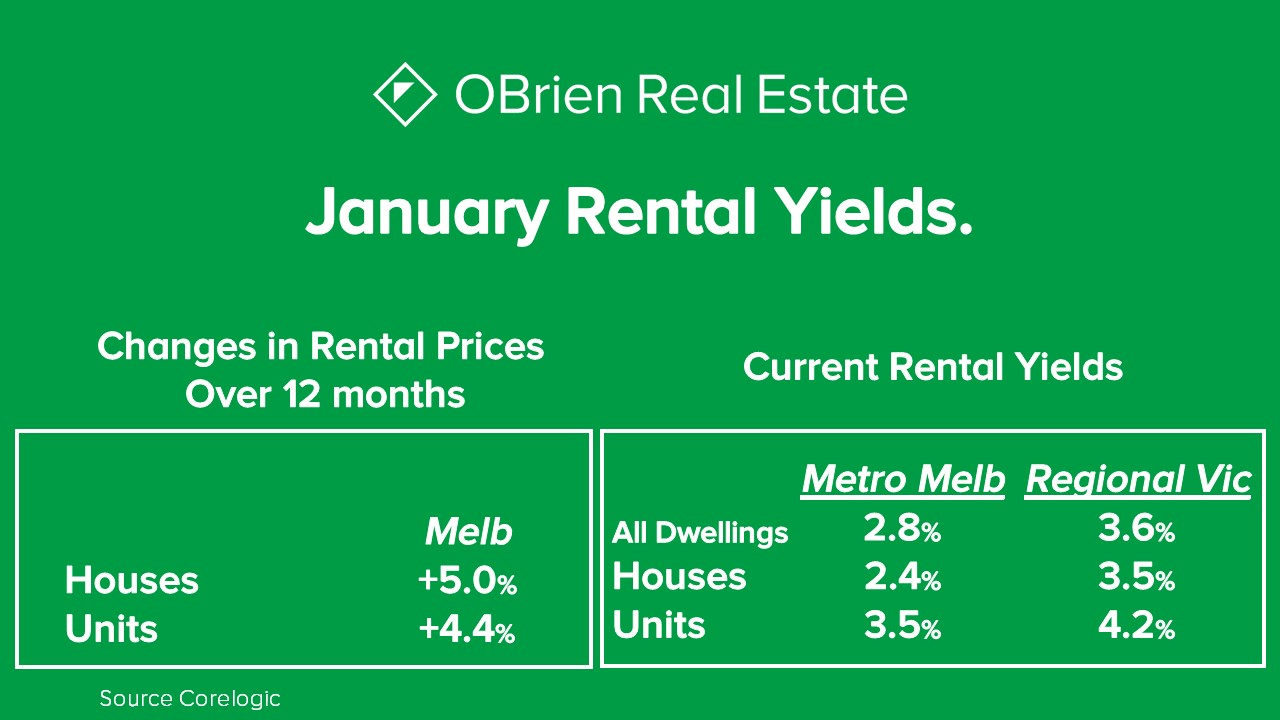

Looking at the next slide on rental performance you’ll see that rental growth yield improved for Melbourne property investors from 2.7% yield to 2.8% rental yield in January. Although rental prices in Melbourne have improved from where they were in early 2021, there is still a lot of room for improvement. National rents are up 9% over the last 12 months whereas Melbourne is sitting at only a 5% increase. Regional Victoria remained steady at 3.6% yield for all dwelling types over January, however Regional Victoria still provides the worse rental yields for property investors out of all the states and territories with Australia.

The trend in new listings coming onto the market will be an important factor in home price growth 2022. Real estate listing supply in 2021 finished on a high with Melbourne the only state above the 5-year trend in the supply of listings, January supply for Melbourne seemed at this stage to be subdued over previous years and this could have an effect on home prices in the early part of 2022.

In other news, the Australian Stock Market in January recorded its worst start to a new year in 14 years, which should give property investors confidence to invest in a stable Victorian property market. The Reserve Bank of Australia meet for its February meeting and announced its intentions to remain patient leaving the cash rate unchanged for at least another month. The commentary that came from the Bank was that it still believes the recent rise in inflation is only temporary and will resolve itself once the supply chain issues are back to normal.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this month, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.