Monthly Property News 2nd Edition 2024.

“Getting Closer to a Rate Cut”

Hi everyone, I’m Jason Mudford from OBrien Corporate with the second edition of the property news for 2024.

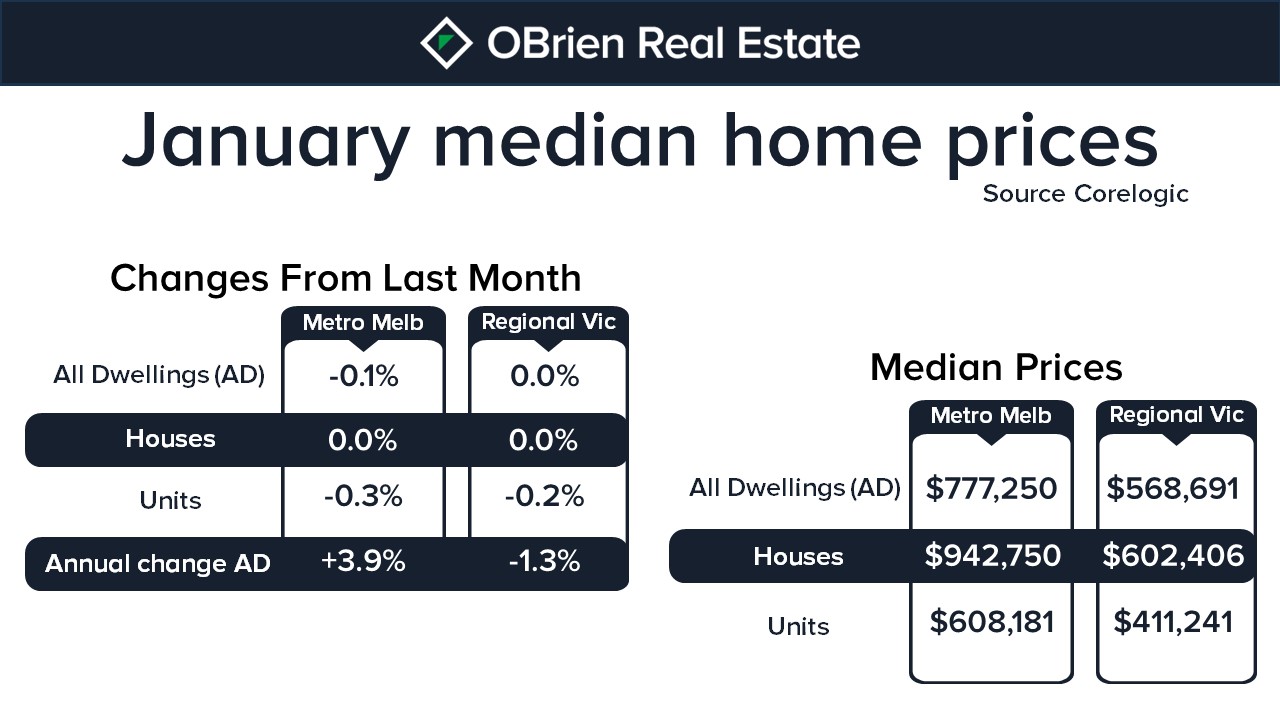

National Home Prices according to our source CoreLogic rose 0.4 percent for January; however, Melbourne home prices fell 0.1 percent, which is the second consecutive month a fall has been recorded in home prices.

The December quarter inflation figures released last week came in at a two-year low of 4.1 per cent when released last Wednesday, which will allow the Reserve Bank of Australia to hold interest rates this month and is now driving speculation on when the first cut will occur in 2024.

The Commonwealth Bank (CBA), Australia’s largest lender, is forecasting three interest rate cuts in 2024 and another three in 2025. The 2024 cuts would take the Reserve Bank’s cash rate down to 3.6 per cent from 4.35 per cent, which is a drop of three-quarters of a percent. The CBA also expects national dwelling prices to rise a further 5% in 2024.

Melbourne’s auctions on February 3 had their busiest weekend to date for 2024, with 608 homes auctioned with a 71.9 percent clearance rate. The OBrien network auctioned 34 homes, recording a 73.5 percent clearance.

Disappointingly, Melbourne was the second worst-performing Capital City for January, behind Hobart. Collectively, the capital cities performed strongly in January, adding on average just under $2000 to the average home price. Likewise, in January, we investors were out in full swing in the US and Australian stock markets, where they broke all-time records. Similarly to Melbourne, Regional Victoria recorded no change in home prices, with no upswing or downswing recorded. Victoria’s overall lackluster performance could be the result of investors being a bit more hesitant with the new 10-year Covid Land Tax levies that commenced 1 January this year.

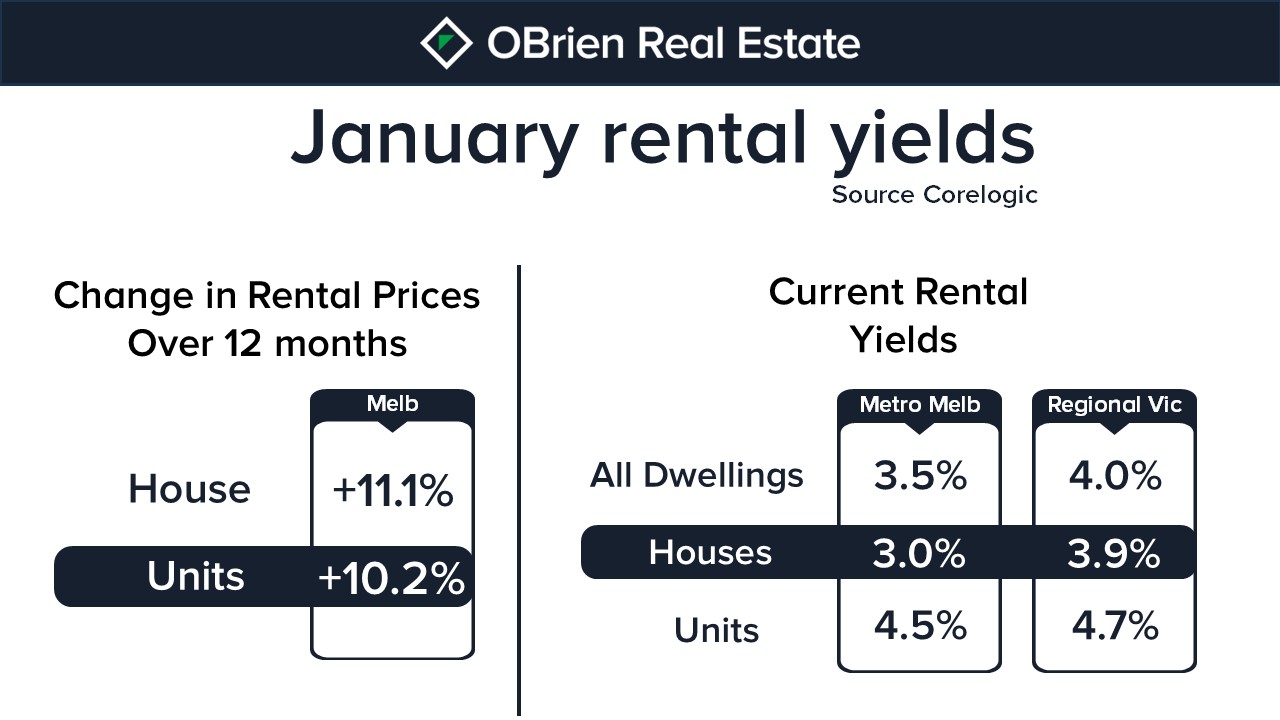

Looking at the performance of the rental market over January, we have hit all-time lows for vacancy rates, which have edged just under 1%. The contraction of housing supply looks set to continue too, with building approval figures released last week by the Australian Bureau of Statistics showing a significant fall of 18.4 percent in Victoria’s dwelling approvals for December; however, nationally, dwelling approvals fell only 9.5 percent in comparison.

That’s all for this February. Remember the information provided is of a general nature; you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports