Monthly Property News 6th Edition 2022

Unemployment at its lowest levels in 50 years

Hi Guys, it’s Dean O’Brien from OBrien Real Estate with the sixth edition of the monthly property news for 2022 where real estate information is on the house.

The Australian Bureau of Statistics released its biennial “Housing Occupancy and Costs” publication for the 2019/20 financial year. There were many significant facts and measures identified, the main being housing affordability for home owners paying off a mortgage has improved to its best level in almost 30 years and that just over 66 per cent of Aussie households are homeowners, equalling the lowest share since 1994/95. Although the market is almost 2 years on from the data set used in this publication, it still tells me a couple of things, the first is that people are resigning themselves to rent rather than buy although the affordability is the best it has ever in a long time and second that it must give property investors confidence to invest.

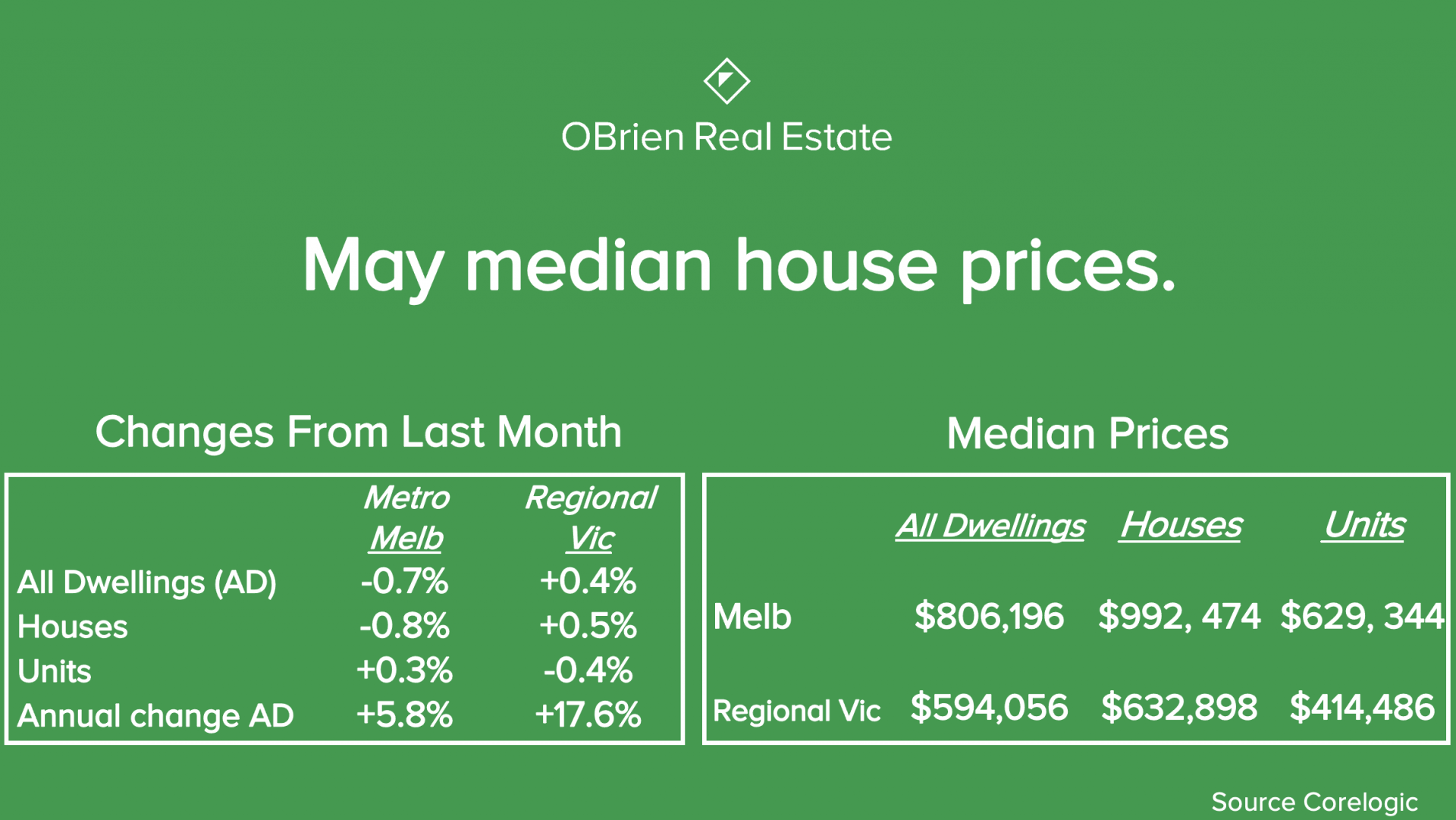

Corelogic released it May Home Value Index and units within Metro Melb surprised the market with a 0.3% increase whereas houses declined 0.8%. Regional Victoria on the other hand increased in both units and houses by 0.4& and 0.5% respectively. Over the last 12 months increases are now only at 5.8% for combined dwellings for Melburnians and but for Regional Victoria growth is still very impressive with a 17.6% increase in values. The combined median house price is now $806,196 for Metro and $594,056 for Regional Victoria

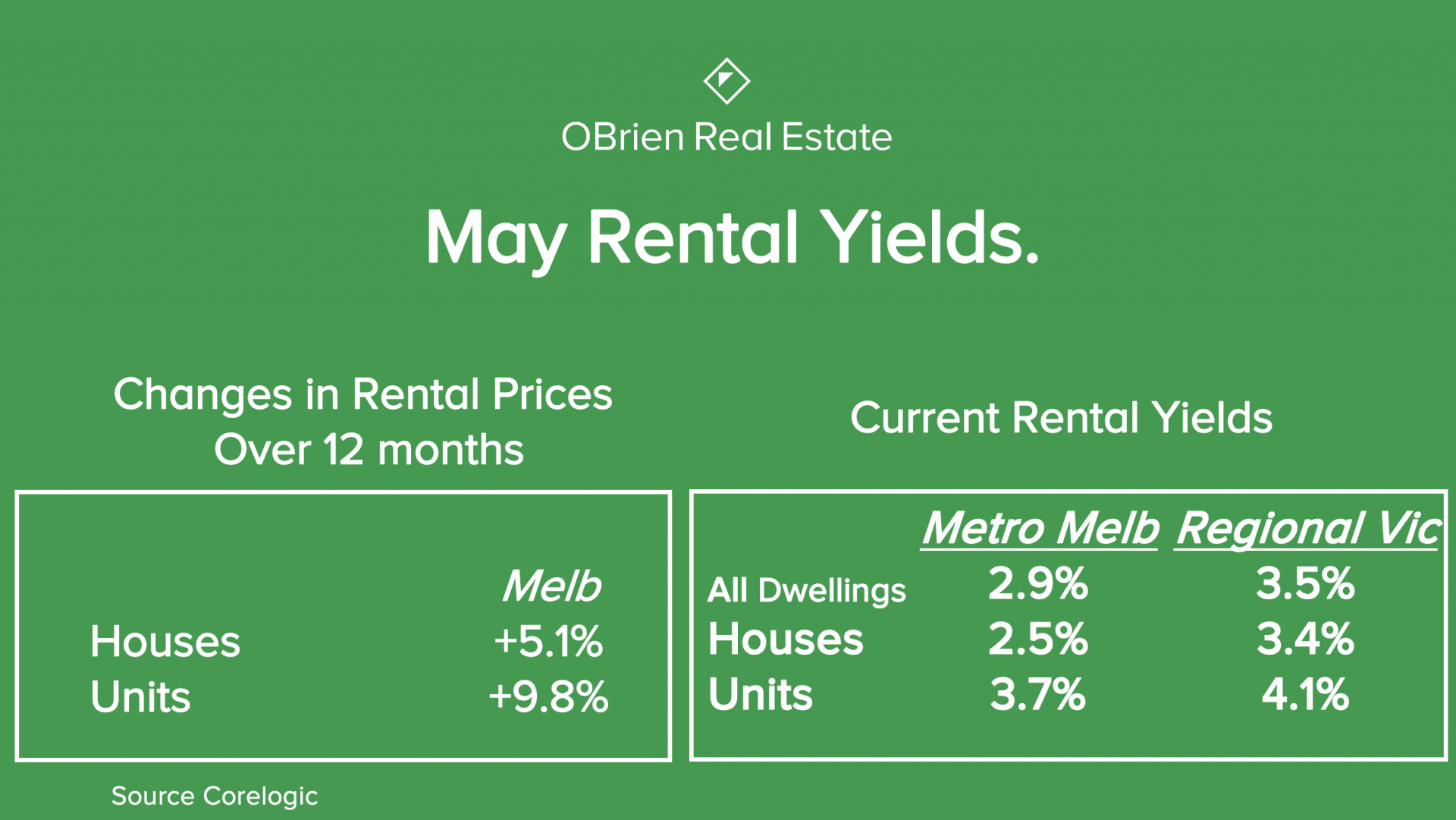

Looking at the rental market, Rents in Melbourne over May lead all capital cities with a 9.8% increase which means rents as an average over a rolling 12 month period is sitting at 5.1%. Unit rents are leading the growth with our boarders now open for overseas visitors, workers and students and the proof is in the data tourism credits are at $459 million to our economy whereas only $79 million in debit. Metro Yields for combined dwelling are now tracking at 2.9%

As you have recently heard the Reserve Bank of Australia increased the official interest rate by half a percent early this month which effectively means that Aussie home borrowers are still enjoying the 5th cheapest interest rates in Australian history.

Brisbane and Adelaide are still leading the capital cities with their growth, currently tracking at a 27.8% increase on home values and 26.1% respectively over the last 12 month. Inventory levels in those markets are the main factor for that growth whereas in Victoria we all know we are sitting 20% above the 5 year average for inventory levels which means buyers are more spoilt for choose.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this month, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.