Monthly Property News 1st Edition 2022

House Price Appreciation Continues to Slow

Hi Guys, it’s Dean OBrien from OBrien Real Estate with the first edition of the monthly property news for 2022 where real estate information is on the house.

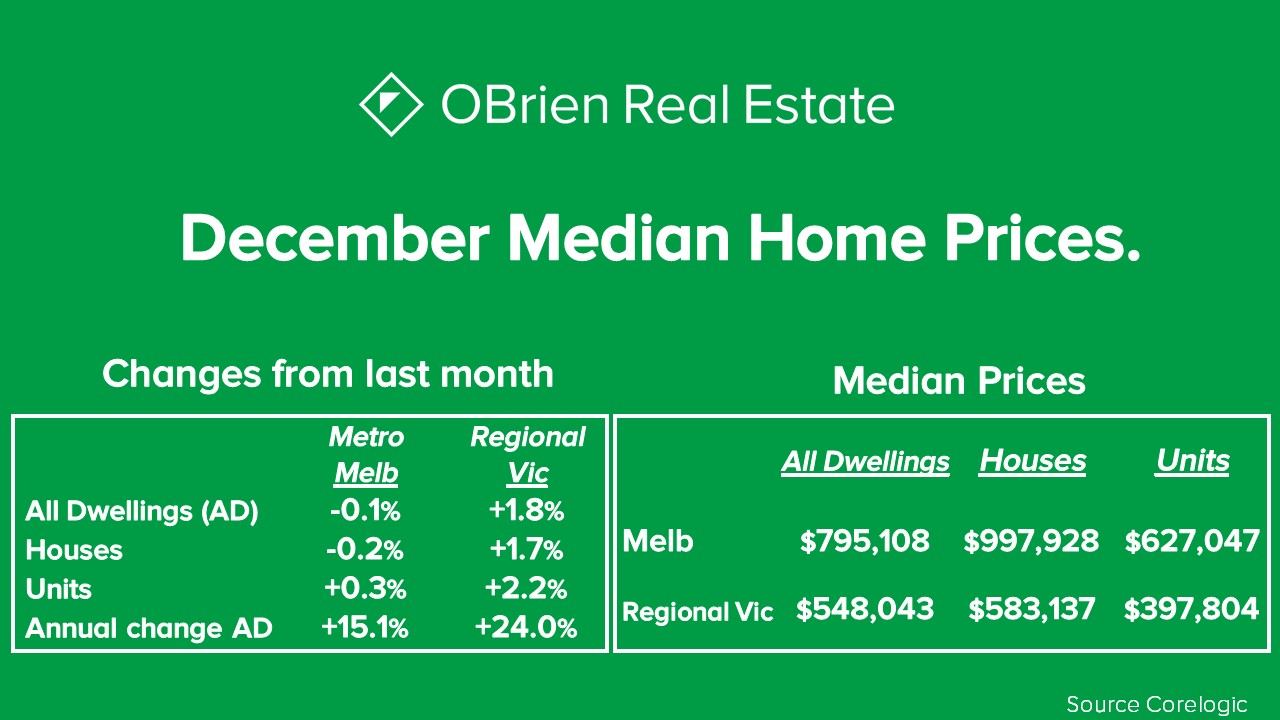

House price appreciation continues to slow across the country, in December we saw National Median House Prices grow by 1% according to the Corelogic Index. Capital Cities across Australia had varying degrees of growth with Melbourne having its first decline since October 2020 with a 0.1% drop and being the only capital city with no growth for the month. On the other end of the scale Brisbane experienced 2.9% of growth followed closely by Adelaide with 2.6%. Regionally the market again out shone the capital cities with an overall 2.2 growth nationally with Victoria recording another strong 1.8% increase in values which officially caps off a stellar calendar year of growth with an average of 24% across all of Regional Victoria. St Andrews Beach on the Mornington Peninsula was crowned the best performing suburb across all of Australia with a staggering 58.6% annual growth in median house price for 2021.

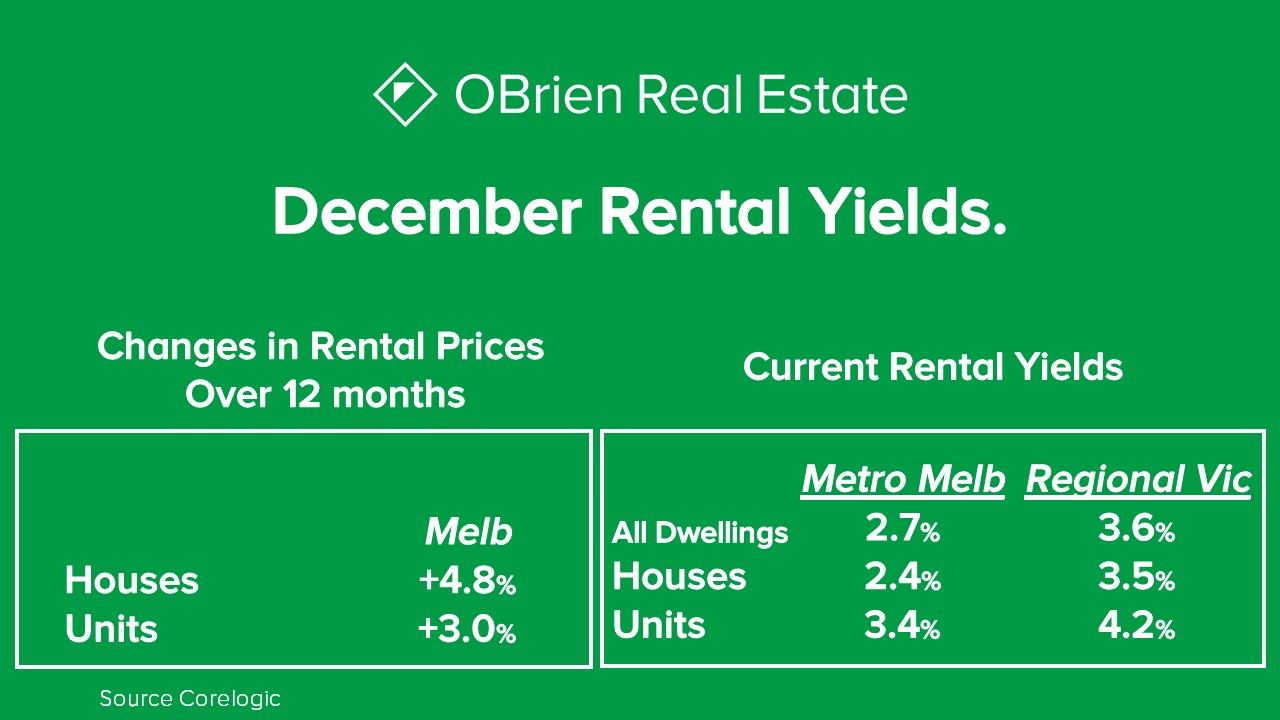

Looking at the next slide on Rental performance you’ll see that rental market for Melbourne’s property investors continues to improve and that is because rental prices achieved are recovering and continues to show good signs that growth will continue for another 12 months at this stage. With December being a relatively quieter month for changeover in the permanent rental market we didn’t see a lot of change in the market, but with the busier months of January and February we expect more activity. Overall rents in Melbourne over the full 12 months of 2021 increased by 4.8% for houses whilst unit prices increased of 3.0%. Overall gross rental yields are still above most investment loan interest rates which is another reason why we are seeing investors looking to invest in real estate in 2022.

Nationally, the advertised inventory finished the year 24.7% below the 5 year average, meaning stock levels across the country continued to be in short supply, however Melbourne was the only state to buck that trend finishing 2021 with housing supply being about the 5 year average While stock levels have generally been low, the total number of home sales in 2021 was approximately 40% above the decade average. CoreLogic estimates there were approximately 653,000 house and unit settlements over the calendar year, the highest number of annual sales on record.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this month, I’m Dean OBrien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.