Monthly Property News 1st Edition 2023

“You can’t stop the waves but you can learn how to surf”

Hi Guys, it’s Dean OBrien from OBrien Real Estate with the first edition of the property news for 2023 where real estate information is on the house.

Welcome to 2023, with every new year, it brings both exciting opportunities and challenges and each year we set and re-set our dreams, our goals and create a plan how we can best navigate these opportunities and challenges.

In real estate there are always waves so it’s important to keep abreast of the market so you can best know how to surf through the waves. 2023 is going to prove no different to any other year, there are tailwinds and headwinds and it is likely to be a bit choppy with home prices initially until we can get a clear understanding of the intentions of the reserve bank on interest rates. CommBank is predicting rates will hit a ceiling soon with another 0.25% increase whereas the NAB predicts 0.50% with ANZ and Westpac predicting the maximum will be reached after another 0.75% of increases.

Last year we had 8 months of consecutive interest rate rises, which means that since May the average monthly repayment had increased by $834 a month based on a $500,000 mortgage. Unemployment levels remain at historic lows and household savings are at record levels, which is playing a role in serviceability which helps to keep a lid on mortgage arrears, which should mean that distress property sellers coming onto the market should be limited.

With economic experts predicting that the bulk of the rate increases already occurred in 2022, housing value declines are likely to find a floor in 2023 which means investors and first home buyers may be enticed back into the market in the second half of 2023 where the market cycle could flip and once again start to climb.

Melbourne Metro declines in the Home Value Index over December fell 1.2%, on a 12 month rolling average Melbourne prices are now 8.1% down for all dwelling types. Regional Victoria has also had another decline similar to last month but easing a little to a fall of 0.7% in December. Regional Victoria now is 1.3% down over the last 12 months.

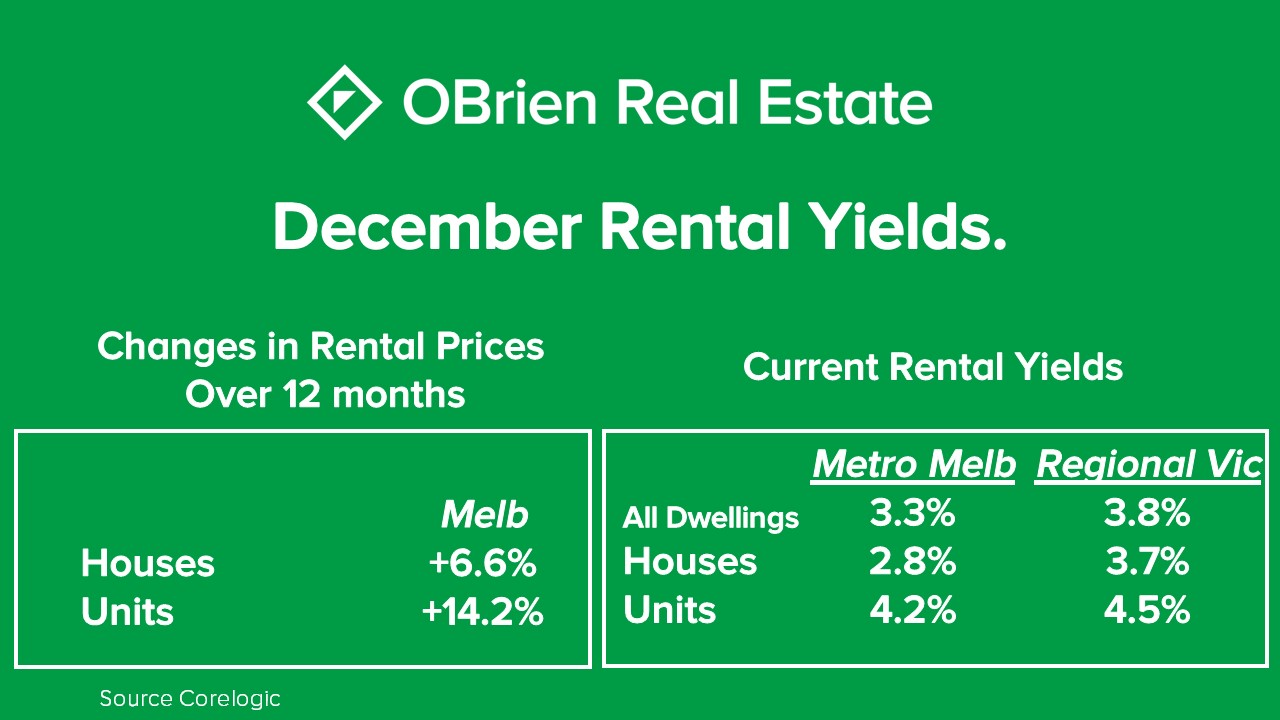

Looking at the rental market, rents in Metro Melbourne during December again increased, with this last month being just shy of 3%. In 2022 we saw 7 consecutive months of rental price growth, the strongest on record and that is likely to keep increasing into 2023. Increases in units in Melbourne are now sitting at 14.2% over the last 12 months and gross yields of units for investors looking in Regional Victoria now sits at a respectable 4.5%.

That’s all for this month, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports