Monthly Property News 5th Edition 2023

“A second consecutive monthly rise”

Hi Guys, It’s Dean O’Brien from OBrien Real Estate with the fifth edition of the property news for 2023.

For two consecutive months now, we have seen Melbourne’s median home prices increase in defiance of the higher interest rate environment. The Reserve Bank of Australia today at 2.30pm decided to increase rates another 0.25 percent, while most pundits in the financial markets thought we had peaked at last month’s Reserve Bank meeting.

The reason for home price increases is mainly attributed to a significant lift in overseas migration and a lack of housing supply. New listings coming to the market are tracking at 22.9% below the same time last year and 14.3% below the 5-year average. With many prospective sellers sitting on the sidelines and keeping stock levels tight, it is providing sellers on the market leverage at the negotiation table.

The buying opportunity that exists in the market right now is the second-best time to buy since 1980, when records were first kept by Corelogic. Across Australia’s capital cities in the last 12 months until February 2023, it had been the second overall largest decline on record with a 9.7% fall in prices, with the largest decline being in 2017–2019, which recorded a 10.2% decline.

There is a growing expectation that the May rate hike is the last in the cycle, and while the bottom of the downturn looks quite convincing, we aren’t expecting housing values to rise materially until interest rates start reducing, which is expected in early 2024, according to Bill Evans from Westpac.

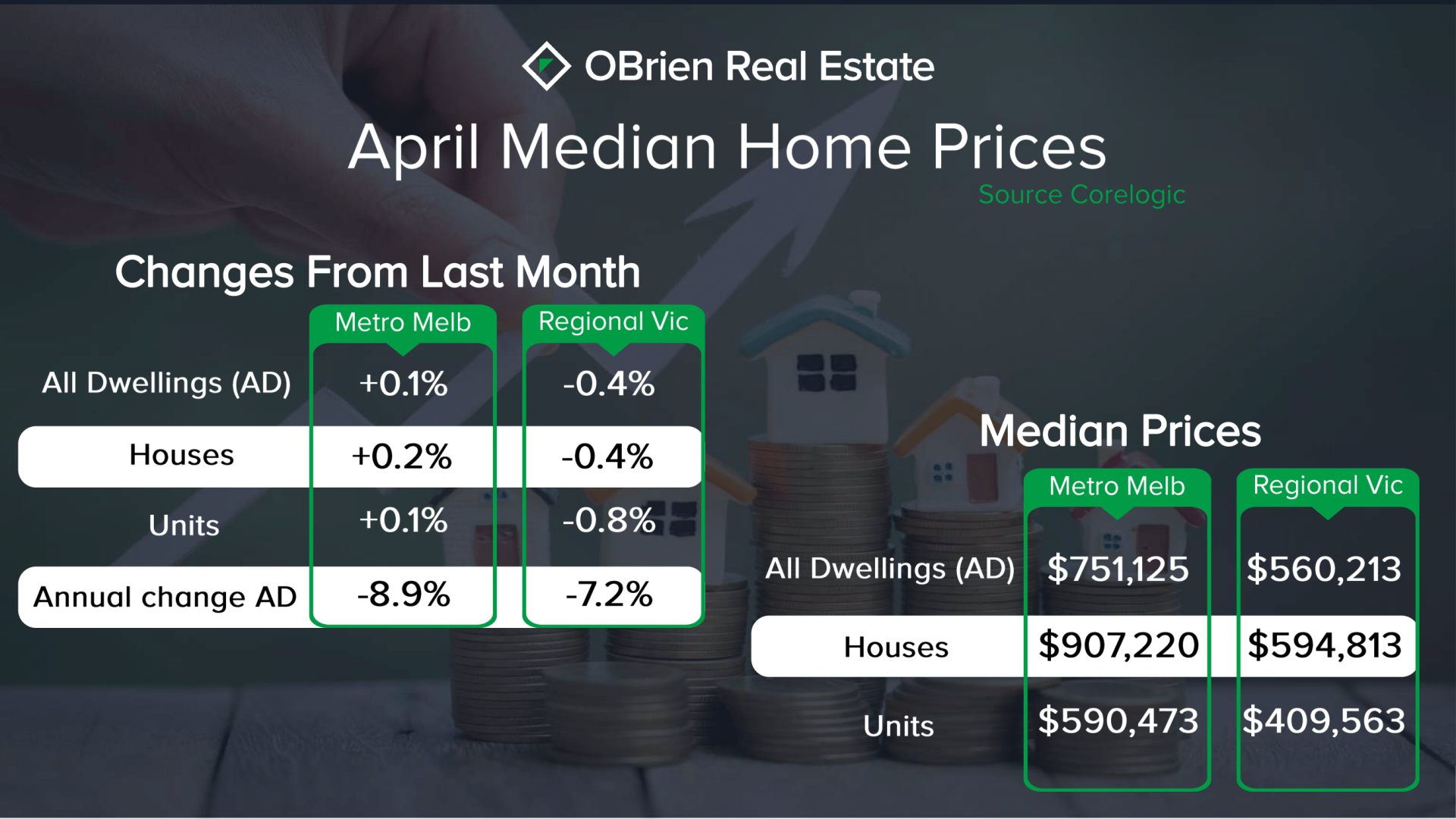

Melbourne Metro declines in the Home Value Index over April grew by the slightest of margins at a 0.1% increase across all dwelling types, with Sydney prices increasing 1.3%. Regional Victoria experienced an easing of 0.4%.

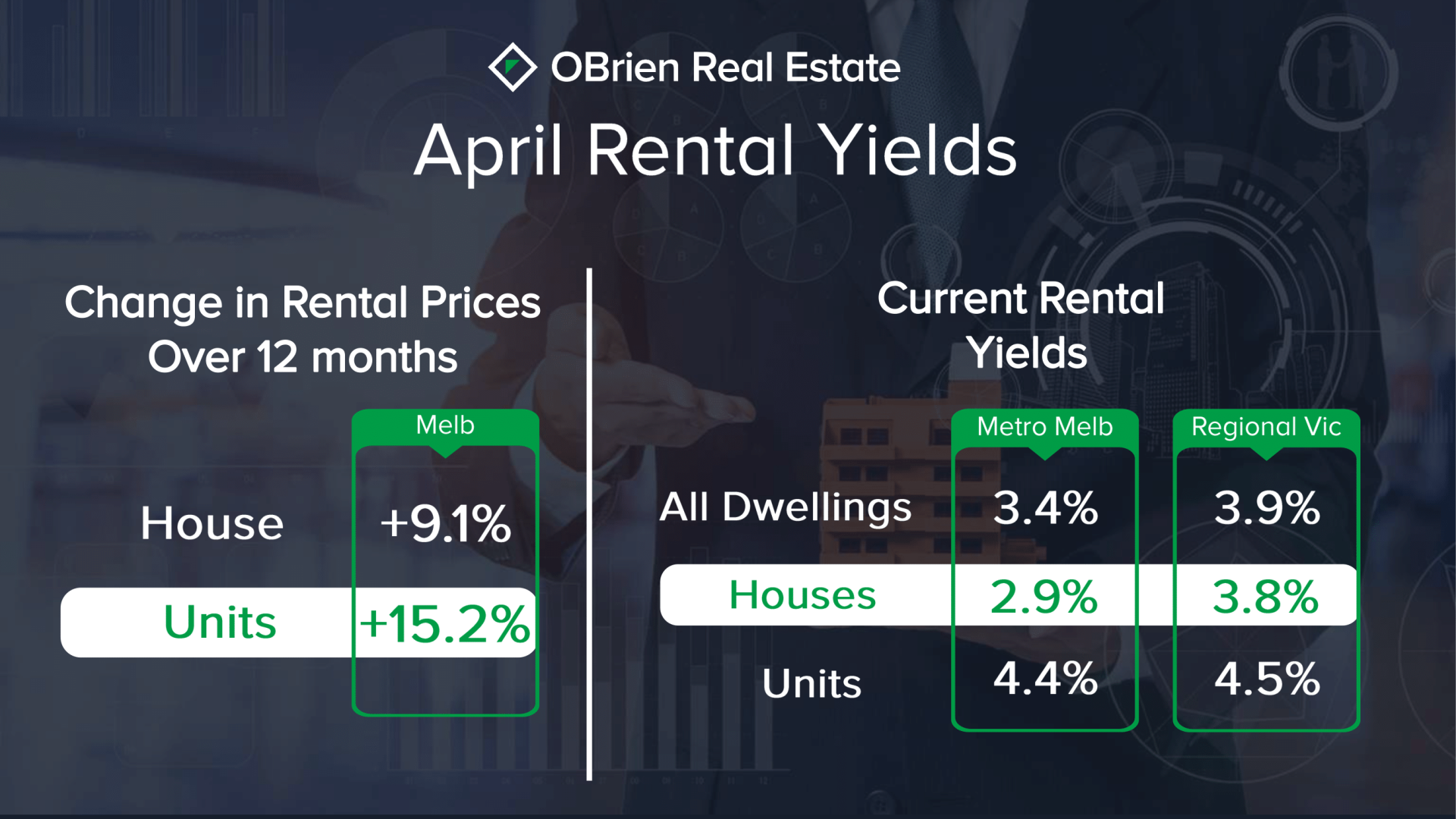

Now, looking at the rental market, rent increases in units across Melbourne are continuing to grow, with the rolling 12-month price increase now at 15.2% and for houses at 9.1%. Vacancy rates are commonly at 1%, which has renters now looking at fast-track purchasing a property with the buying market presumably now at the bottom, and consequently, these renters turned buyers are also avoiding the strong competition in the rental marketplace.

That’s all for this month, I’m Dean O’Brien, and remember that the information provided is of a general nature. You should always seek independent legal, financial, taxation, or other advice in relation to your unique circumstances.

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports