Monthly Property News 6th Edition 2023

“Home prices continue to accelerate”

Hi Guys, It’s Jason Mudford from OBrien Real Estate with the sixth edition of the property news for 2023.

Home prices are defying the persistent interest rate hikes mainly due to the lack of property listings on the market. Right now, it’s the small pool of properties we have had on the market for 10 years, and it is a great opportunity for home sellers to beat the traditional spring selling rush. Some sellers are delaying going to market, the reason for the pause could be because they are waiting for good news before taking the leap to sell, but the smart sellers are capitalising on the short supply in the market, and maximising their sale price, and beating the spring rush. We have seen home prices nationally increase by 2.3% in the last 3 months. The Sydney market, which usually leads the way out of a declining market, has risen 4.8% since January, or $48,390 in dwelling values.

Our State Government’s Land Tax changes have taken many property investors by surprise, with many mum and dad investors already really feeling the interest rate hikes. Property investors in holiday homes and rental properties, on average, will be paying an additional $1,000 each year under the government’s 10-year plan. Increases will add more fuel to the rental market crisis, with rents likely to go up to help subside the burden of land tax increases.

New building approvals have also experienced a drastic drop, falling 8.1 percent in April after just a one percent decrease in March. Private sector dwelling approvals for houses are now down 18.6% year on year, and for units, they are down a hefty 24.2%. The lack of building approvals will keep the pressure on supply, particularly with the large increase in migration numbers to Victoria.

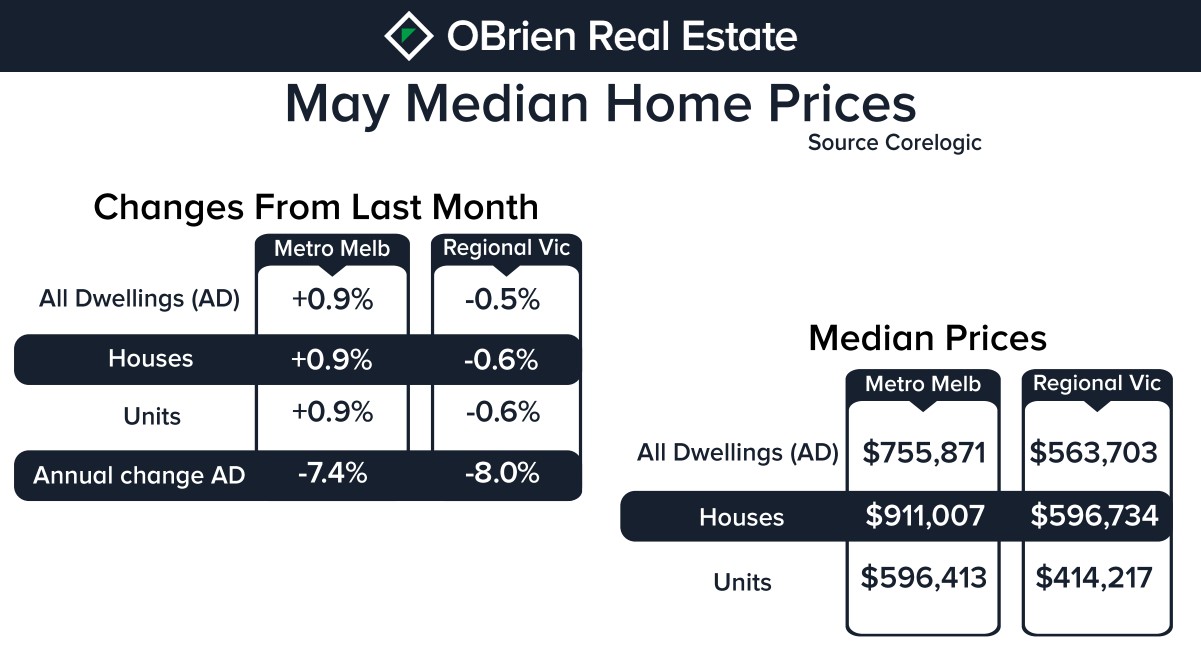

The Melbourne Metro Home Value Index, as reported by Corelogic over May, grew by 0.9%, or $4,746 on average, for all dwelling types. Regional Victoria, on the other hand, experienced a decline of 0.5%, or $3,490 on average, for all dwelling types.

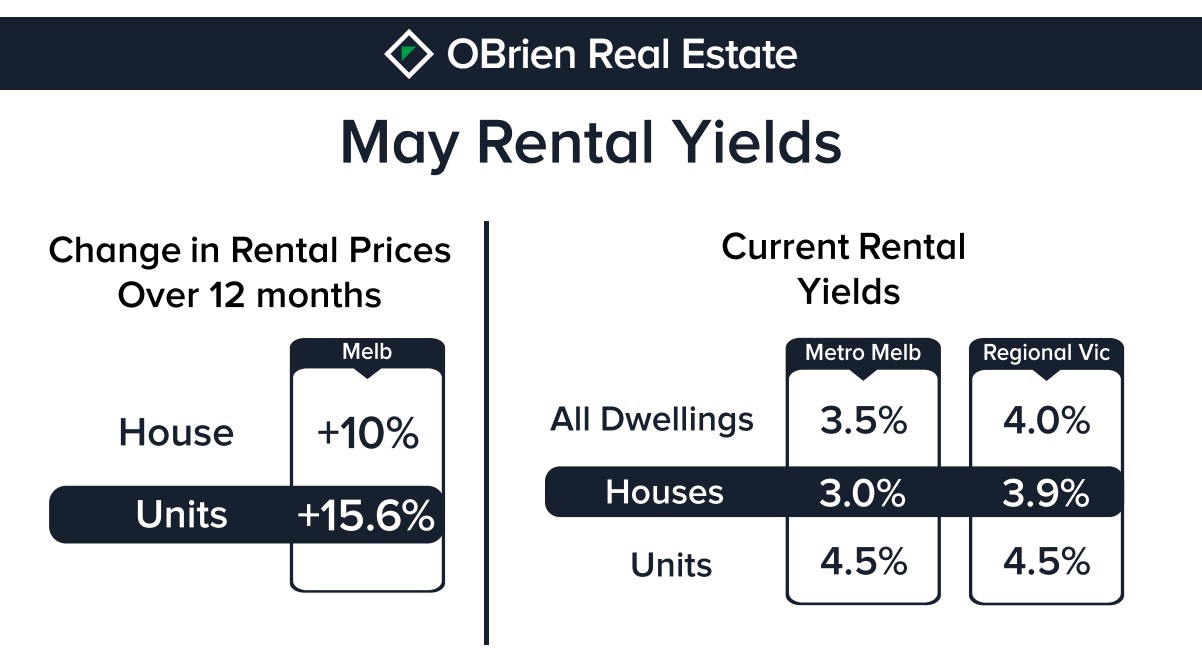

Now, looking at the rental market, rent increases are continuing to increase, with a 0.8% increase nationally. Units across Melbourne over a rolling 12-month period are at a 15.6% increase and at a 10% increase for houses. The news for the rental market looks set to continue, with property investment loans down 29.4% year on year, which ultimately will place more pressure on supply.

That’s all for this month. I’m Jason Mudford, and remember that the information provided is of a general nature. You should always seek independent legal, financial, taxation, or other advice in relation to your unique circumstances. Thank you for taking the time to watch this month’s market wrap, and until next time, bye for now.

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports