Monthly Property News 7th Edition 2023

“Market continues to perform”

Hi Guys, It’s Jason Mudford from OBrien Real Estate with the seventh edition of the property news for 2023.

Welcome to the new financial year, and the Reserve Bank of Australia has started off the new year with some good news for homeowners by pausing the interest rate cycle and keeping the cash rate at 4.10%. The main reason for doing so would have been the better-than-expected inflation numbers that came out in late June, where it dropped from 6.8 per cent in April to 5.6 per cent in May.

Over the four auction weekends in June, the REIV reported 2,196 auctions, of which an overall 1479 sold, providing a clearance rate of 79%. We had school holidays in June, which meant the number of auctions compared to May was down, but the clearance rates in June improved over May; in fact, June’s clearance rate has been the best result for the “Year to Date”.

Traditionally, there is less seller competition in the colder months, but selling when the market is this strong is a smarter move than waiting for the warmer spring weather when listing supply is likely to increase, giving buyers more choices, which will place downward pressure on sale prices. The other reason to consider selling now rather than waiting is because fixed-rate mortgages are switching to variable rates, and this is certain to increase through the remainder of this year, which will have homeowners considering a sale of their property due to the now high holding costs.

The Australian Bankers Association (APA), which is made up of the Big 4 banks, has said that around three times as many fixed-rate mortgages (222,800) will expire over the June quarter compared to what expired over the March quarter (78,300), and for the September quarter there are also large volumes of fixed-rate mortgage expirations with 208,000 and 184,000 for the December quarter.

So, to reiterate, the stronger-than-ever auction clearance rates show demand is running strong. The demand is reinforcing property values and creating stability now, so it’s a good environment to sell your home with the least amount of competition possible.

In other news, the Australian Bureau of Statistics (ABS) reported the number of loans issued for the purchase or construction of a new home plunged to a record low in April, down 74% from the January 2021 peak, and retail figures rose 4.2% in May compared to last year. In summary, the reality is that interest rates are now a month-by-month situation; some data points are showing a slowdown, but contrary to this, some areas are still feeding inflationary pressures.

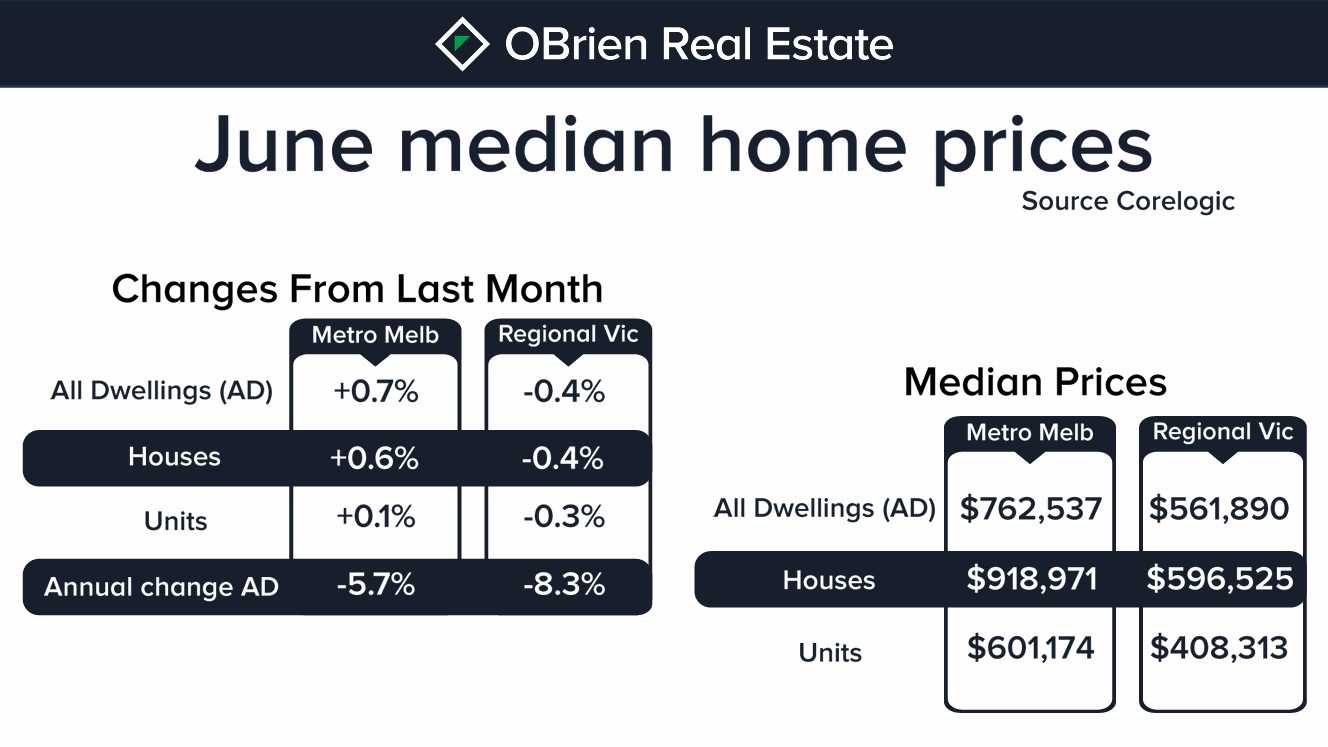

The Melbourne Metro Home Value Index, as reported by Corelogic over June, grew by 0.7%, or $6,665, on median prices for all dwelling types. Regional Victoria, on the contrary, experienced a decline of 0.4%, or $1,813 on the median price average for all dwelling types.

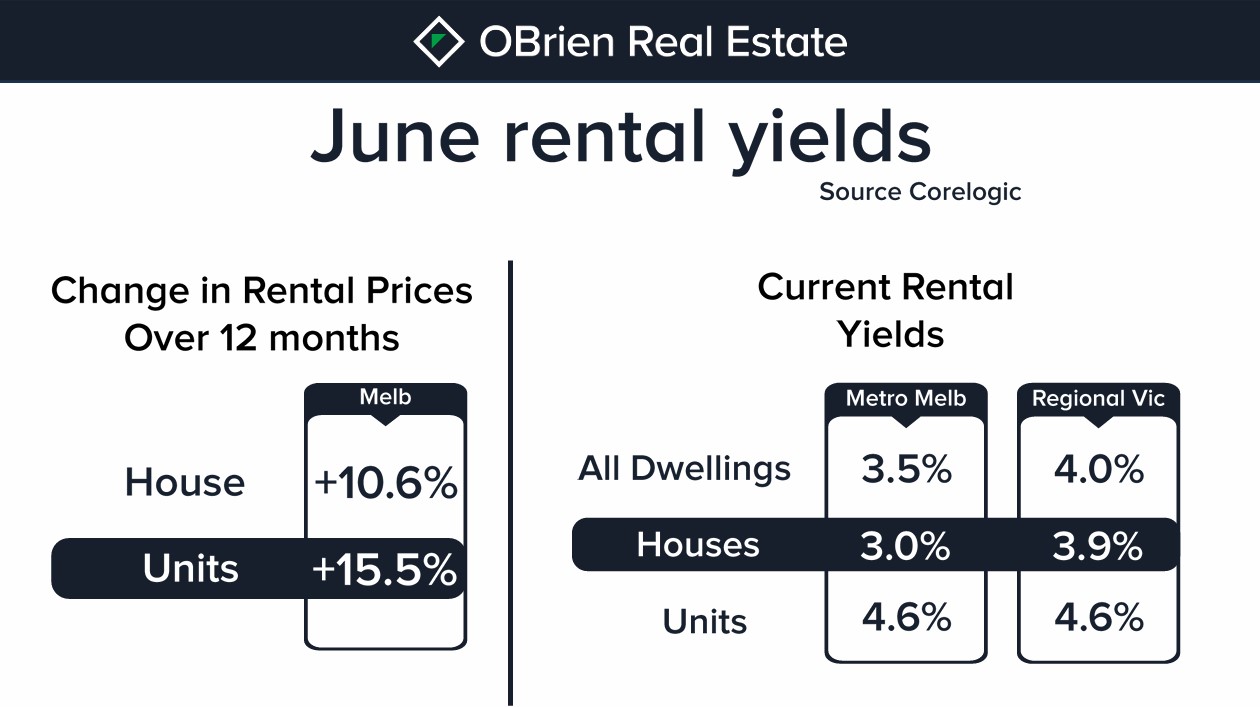

Now, looking at the rental market, rent increases in Melbourne grew strongly in June to post an increase of 1.1%, with the median rent in Melbourne for all dwelling types now at $551 a week. Vacancy rates are at 0.8%, and Melbourne was recorded for the last financial year as being the cheapest capital city to rent a property in. Hobart was the second cheapest at $552 a week, followed by Brisbane at $614, Darwin at $600, Perth at $599, Adelaide at $549, Canberra at $669, and Sydney at $773 a week. The news for the rental market looks set to continue, with property investment loans for new homes down 74% from their peak in January 2021.

That’s all for this month. I’m Jason Mudford, and remember that the information provided is of a general nature. You should always seek independent legal, financial, taxation, or other advice in relation to your unique circumstances. Thank you for taking the time to watch this month’s market wrap, and until next time, bye for now.

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports