Monthly Property News 8th Edition 2022

All eyes are on the Reserve Bank

Hi Guys, it’s Dean O’Brien from OBrien Real Estate with the eighth edition of the monthly property news for 2022 where real estate information is on the house.

All eyes are on the Reverse Bank with another expected rate increase tomorrow. With the rate of inflation at 6.1% as reported by the Australian Bureau of Statistics last week, there is concern from homeowners on how already tight households’ budgets will cope. The Wage Price Index was also released showing a rise of only 2.7% which is not keeping up with increased expenses and to make matters more challenging the temporary fuel excise cut comes to an end in September. However, there was some good news released in early July from the Albanese Government announcing thousands of new places for the Home Guarantee Scheme. The program has been expanded with 35,000 new places to support first home buyers to purchase a home with as little as a five per cent deposit and 5,000 places to assist single parents with dependents to purchase a home with as little as a two per cent deposit

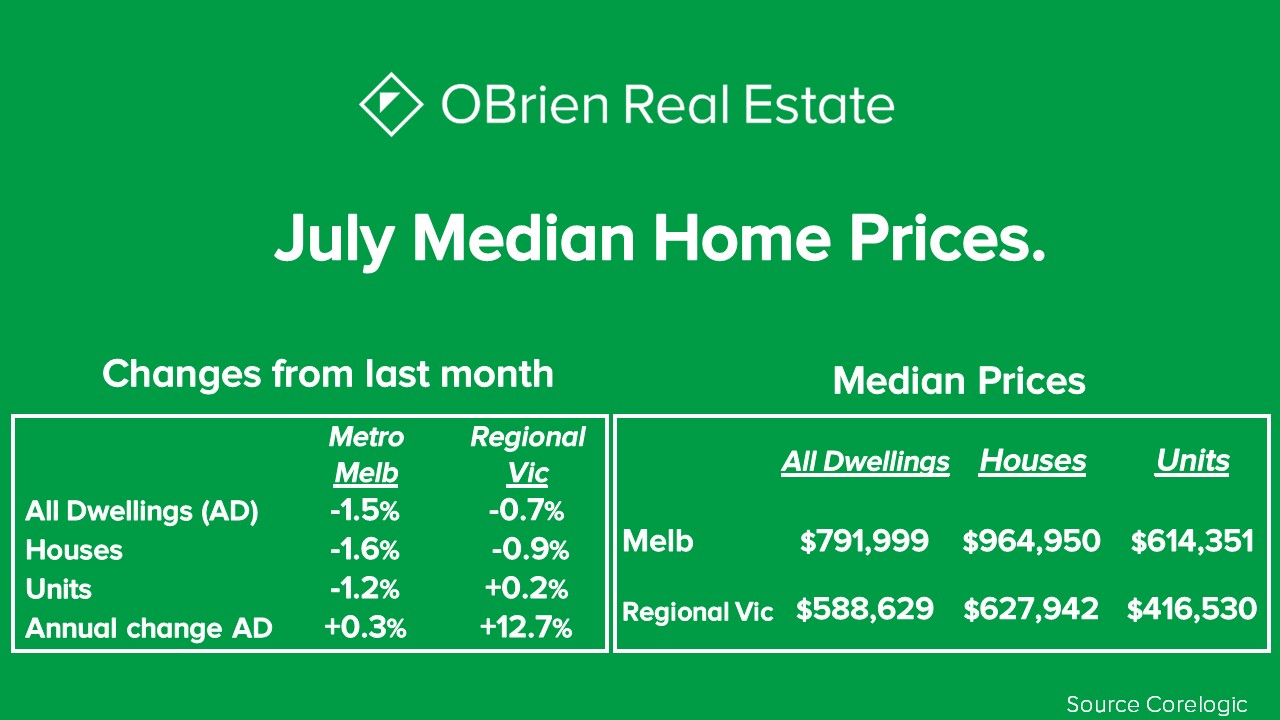

Corelogic released its July Home Value Index on Monday and nationally prices for all dwellings were down 1.3% with Sydney topping the capital cities, falling the most with a 2.1% drop followed by Melbourne with a 1.3% drop. For Regional Victoria values came off for the second consecutive month falling 0.7% for all dwellings, however units performed better posting a 0.2% gain, regional prices over a rolling 12 month are now sitting at a 12.7% increase. Melbourne and Sydney still remain 8% to 10% above normal stock levels whereas capital Adelaide and Brisbane are still down 30% of available listing which is helping pricing remain firm.

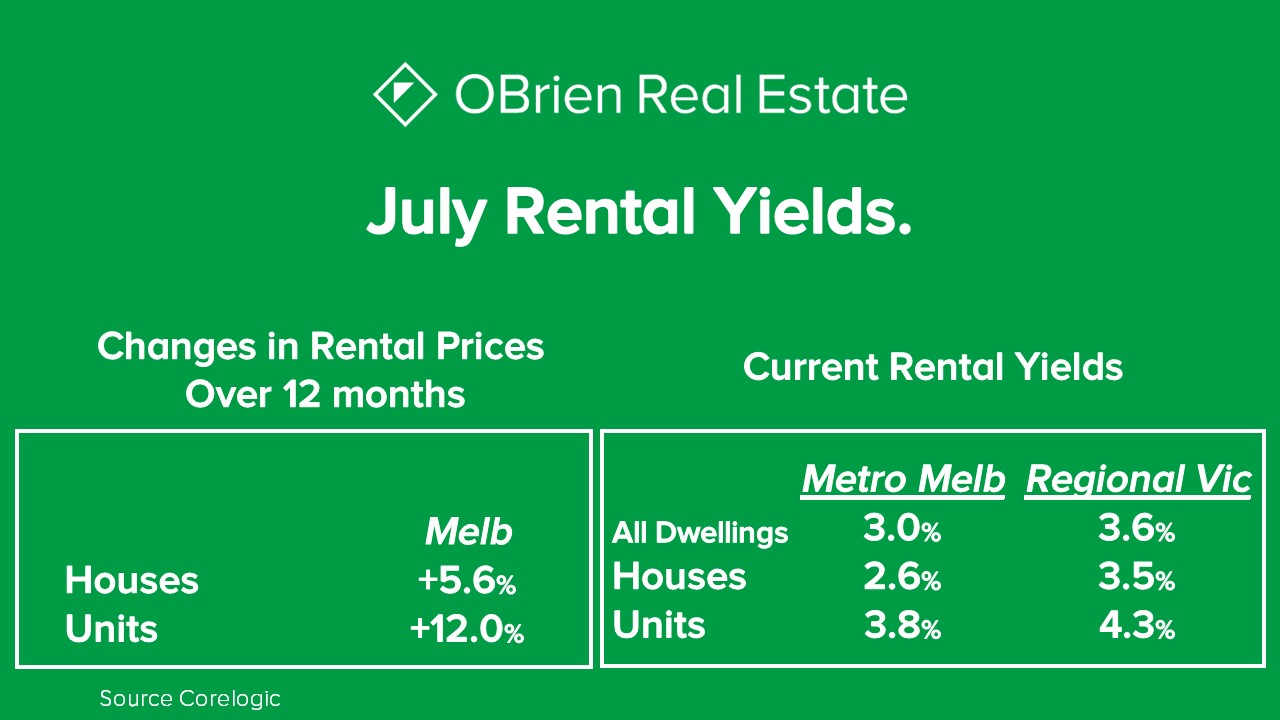

Looking at the rental market, rents in Melbourne again increased on an average of 8% for the month of July for combined dwellings. The signs for the rental market, are pointing towards further rental increases which is being caused by a lack of supply of properties, higher interest rates and the continual increase in overseas arrivals. Economists are forecasting rental price significant gains, some up to 30% over the next 12 months. Renters unfortunately will be challenged equally as much as the prospective owner occupiers in today’s market.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this month, I’m Dean O’Brien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.