Monthly Property News 8th Edition 2023

“It’s going to be a slow recovery rate“

Hi Guys, It’s Jason Mudford from OBrien Real Estate with the eighth edition of the property news for 2023.

And the good news is that the Reserve Bank has decided to pause increasing interest rates for the second month in a row. The Comm Bank had surveyed 30 economists before the rate decision was handed down, with 18 predicting an increase and 12 predicting a pause, it’s good to see most economists got it wrong. The main reason for the pause, which came from the Reserve Bank’s Meeting minutes, was the drop in rising inflation to an annualised rate of 6% and a steady unemployment number of 3.5%. Building approvals were released on Tuesday, with total dwellings approved decreasing by 7.7% on the previous month, which brings the annualised decrease to 18%, which no doubt will affect future housing supply, which in turn puts pressure on rentals and sales prices. Considering the population boom prediction that is coming in the next 18 months to 2 years, I am sure the Reserve Bank is conscious of not wanting to add fuel to the fire by making it harder to invest in real estate.

Over July in Victoria, we had another busy auction market with the REIV reporting 2622 auction results with 1706 selling, producing a 75.5% clearance rate, and there is a trend that we have noticed over the last couple of months, which is the number of auctions now selling beforehand. The number for July was up by 2%, or 88 sales, on the previous month.

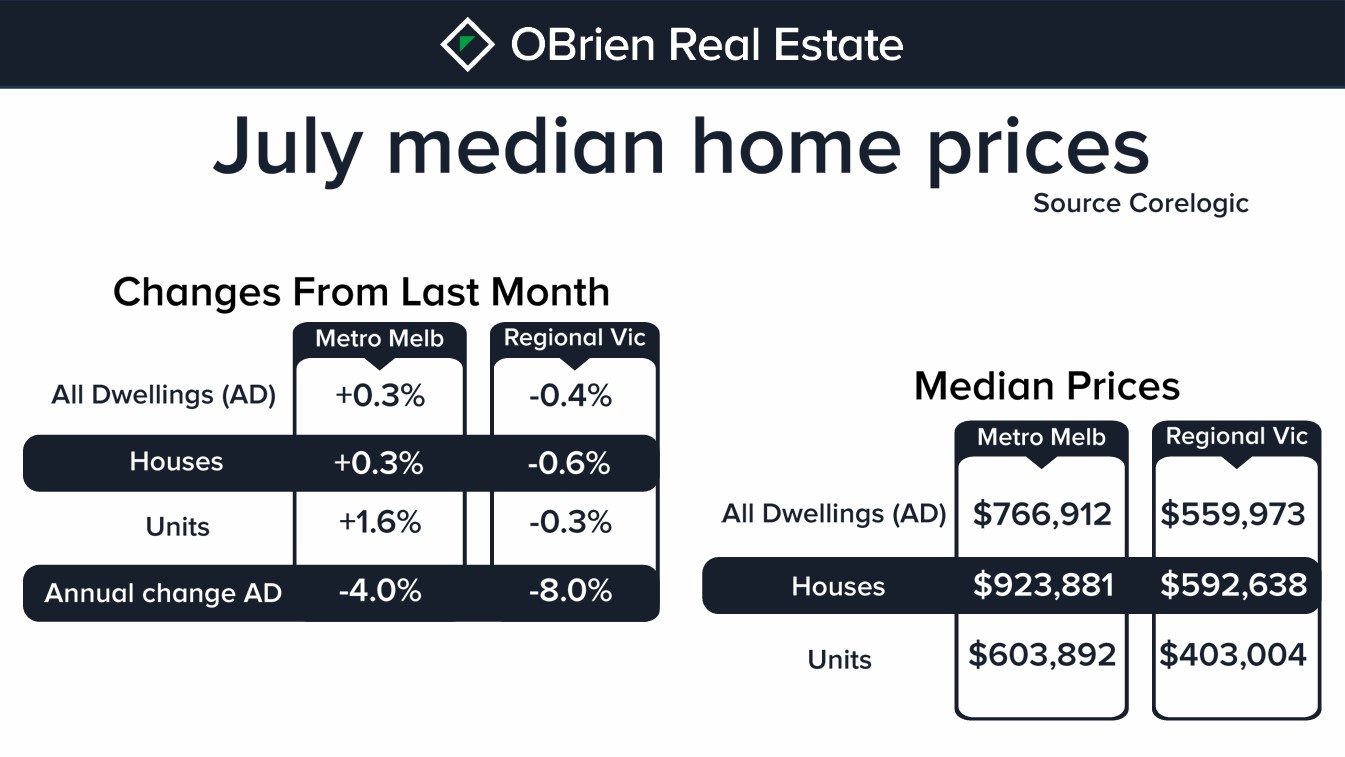

The turnaround seems to be spreading more across unit sales than house sales, with unit prices up 1.6% this last month and 1% on the previous month. This would be mainly due to affordability and borrowing capacity. The overall market has now risen each month since finding its floor in February, so the market is stronger and it is a good time to be considering selling, but we are finding most purchases made in 2021 and early 2022 during the post-COVID boom are still going to fall short of getting their money back.

July sales across OBrien increased approximately 12% in comparison to July last year, and this is most likely due to smart homeowners wanting to cash in and beat the spring rush and the mortgage cliff. The Australian Bankers Association, which comprises only the Big 4 banks, has reported that from July through September, there were 208,000 fixed-rate mortgages switching across to variable rates, so there are still challenges ahead to be wary of.

Specifically looking at the Melbourne Metro median prices for all dwelling types, in July the market produced an overall increase of 0.3% as reported by Corelogic, whereas Regional Victoria, which was once the bolter during lockdowns, was again the decliner, falling 0.4% for July or 8.0% annualised.

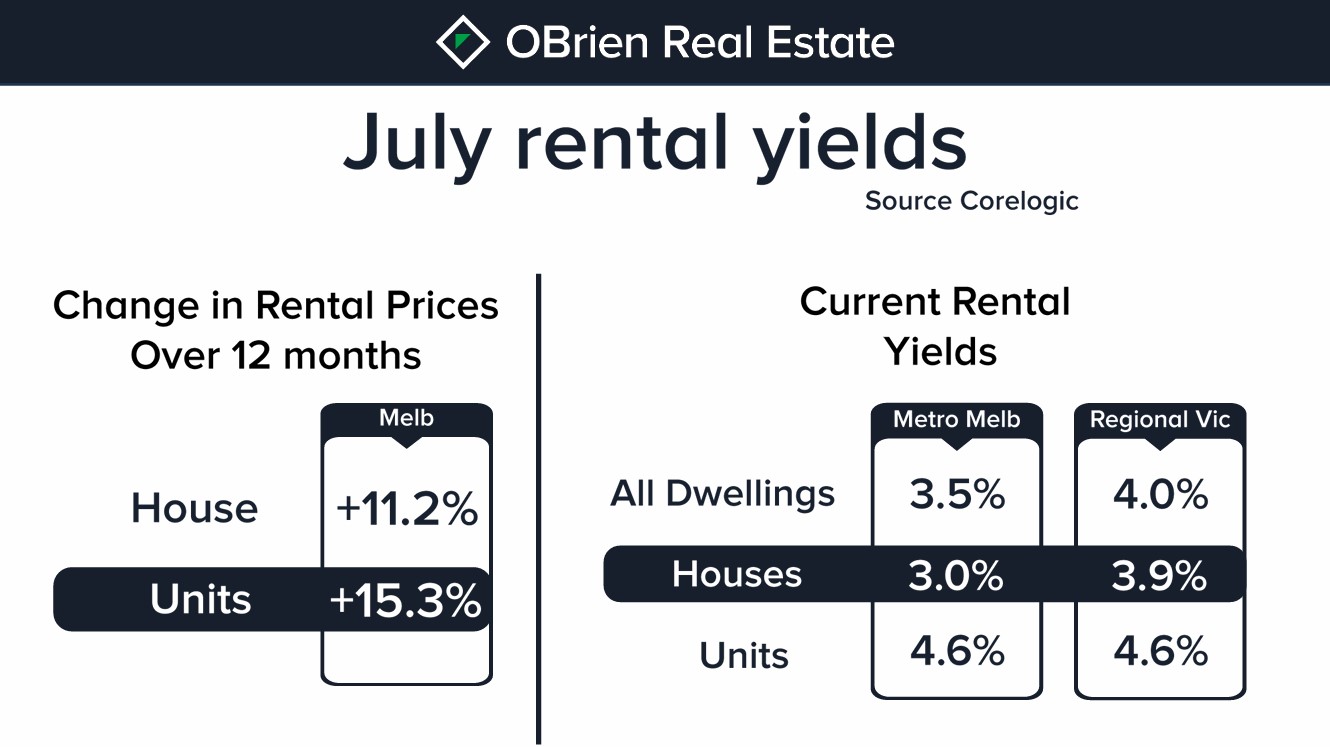

Now, looking at the rental market, rent increases in Melbourne continue to rise despite media speculation that rental prices may have peaked. Rental prices grew by approximately 1% over the month of July. Property Investors are hearing the news that Daniel Andrews might price cap rental prices, but the reality is that Melbourne is still the cheapest capital city to rent a home compared to every other capital city in Australia. I imagine that is surprising to most people considering Melbourne was once the most liveable city in the world and Melbourne is Australia’s third most expensive capital city to buy a home in after Sydney and Canberra.

That’s all for this month. I’m Jason Mudford, and remember that the information provided is of a general nature. You should always seek independent legal, financial, taxation, or other advice in relation to your unique circumstances.

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports