Monthly Property News 9th Edition 2023.

“The sixth consecutive monthly rise in home prices“

Hi guys, I’m Jason Mudford from OBrien Corporate with the ninth edition of the property news for 2023.

The National Cabinet meeting in mid-August rejected the 2-year Rent Freeze campaign, with the next big national topic on housing to be in October with parliament sitting to officially decide on the Housing Australian Future Fund (HAFF). The HAFF is a $10 billion initiative designed to help deliver 1.2 million new homes to the market by 2029. The scheme will focus on States and Territory zoning and planning reforms for medium to high-density living with the states to be incentivised to make reforms to encourage and speed up private construction. The government agency NHFIC however, still forecasts 175,000 dwellings to still be undersupplied by 2027.

Over August in Victoria, the REIV reported another strong auction clearance rate of 74.50% for the month. Home values in Metro Melbourne have been increasing slightly each month over the last 6 months with home values for houses and units so far this calendar year up 1.7%. Although a slow recovery, further moderate increases can be expected with interest rates considered to have peaked, which will help both buyers and sellers to comfortably commit to transacting further in this market, with the confidence prices will continue to moderately increase with living pressures easing.

The spring market this year is likely to be more active if winter is anything to go by with slightly higher than expected stock levels likely to come market. The strength of the market we are seeing is that if you have a quality home that is well presented by way of renovation or a recent new build it is attracting stronger buyer demand. We expect homes of these types to outperform the rest of the market, particularly with the strong demand from population growth still not yet coming to fruition. A great example of a quality home, well presented is 6 Davies Street in Brighton East, which was auctioned by OBrien last weekend selling for $3.61 Million, it was a recently built home of 5 bedrooms in a quality street, which in fact achieved Melbourne highest reported auction result.

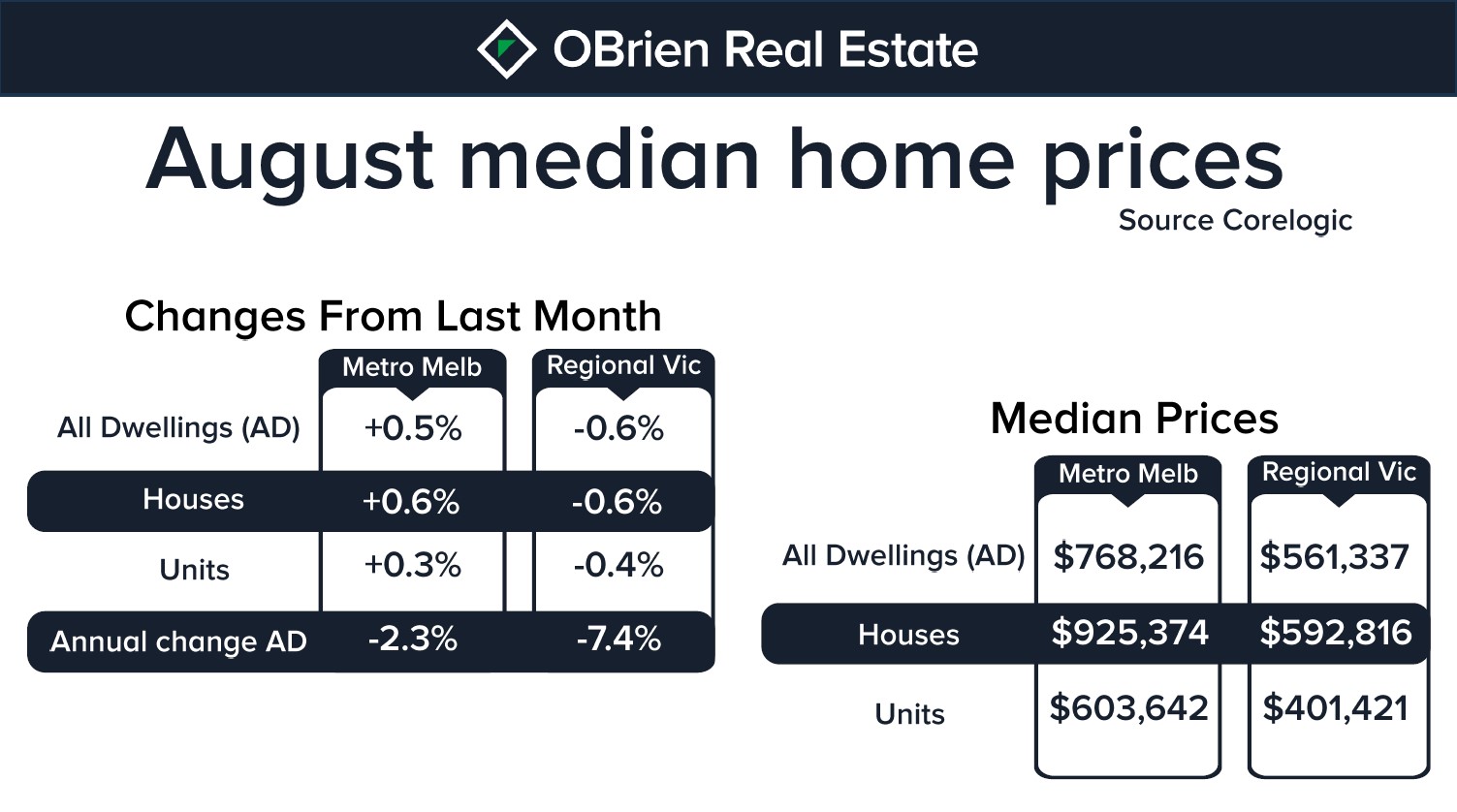

If we specifically look now at the Home Values Index as reported by Corelogic, Melbourne Metro median prices in August for all dwelling types produced an overall increase of 0.5% as reported by Corelogic whereas Regional Victoria, which was once everyone’s solace during lockdown was again the decliner falling 0.6% for August.

Now, looking at the rental market, nationally rent increases has now had 36 months of consecutive increases and some might say that the peak of rental increases must be close. However, Melbourne is still the cheapest capital city to rent in, and as a yield to property investors, it is producing the 2nd worst returns of all capital cities at 3.5% across all dwelling types. Vacancy rates nationally is now at 1.1% and the 10-year average for vacancy rates is 2.8% which indicates we are in desperate need for more housing supply for renters across every state and territory.

Lastly, lending indicators were released by the Australian Bureau of Statistics yesterday and new lending for investors was down again for July and is now 7.2% down on a annualised basis, however, with 3 of the big 4 banks saying interest rates peaked in June, we believe investors will start returning to the market this spring and with Westpac predicting rate cuts to commence in March 2024 the timing is probably right.

That’s all for this month. I’m Jason Mudford, and remember that the information provided is of a general nature. You should always seek independent legal, financial, taxation, or other advice in relation to your unique circumstances.

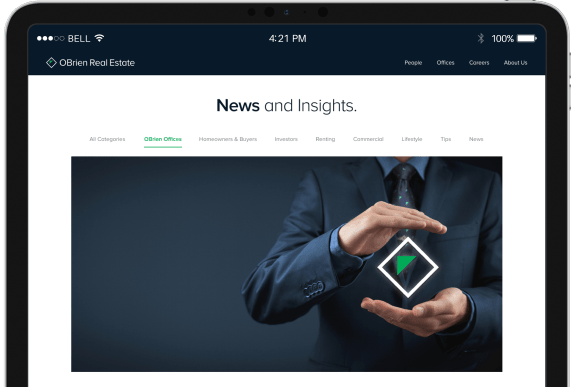

Check out our website for:

Scheduled Auctions

This Week’s Opens

Our Suburb Reports