Weekly Property News 7th Edition 2021

Australia’s Real Estate Prices are the 8th wonder of the world

Hi Guys, it’s Dean OBrien from OBrien Real Estate with the 7th edition of the Property News for 2021 where real estate information is on the house.

Welcome to autumn Melburnians. This Monday Corelogic released their Home Price report and Australia wide the values in residential property for the month of February has been the strongest in 17 years. In Metro Victoria, an overall growth rate of 2.1% was achieved for the month with Houses rising by 2.4% to a median house price of $829,509 and Units rising only half of that with a 1.2% increase to a median price of $582,833.

Within Regional Victoria, the growth story was even better for homeowners, overall the growth for the month was 2.6%, for Houses it was 2.6% and Units in this instance increased more than houses, increasing 2.8% which is quite the contrary to Metro Melbourne.

This week throughout the media there has been talk real estate prices are too hot at the moment. However, interestingly in Metro Melbourne prices are still 1.3% off their peak from 12 months ago. The reality of the situation is interest rates drive real estate prices. Here is a graph that shows property price growth in direct correlation with interest rate changes over a 20-year period. Every movement up or down correlates with a price change. So with borrowing costs at rock bottom and government stimulus encouraging record finance approvals, we’ll see growth continue for some. Let’s not forget that Westpac only released their latest forecast last week predicting 18% growth for Melbourne over the next 2 years.

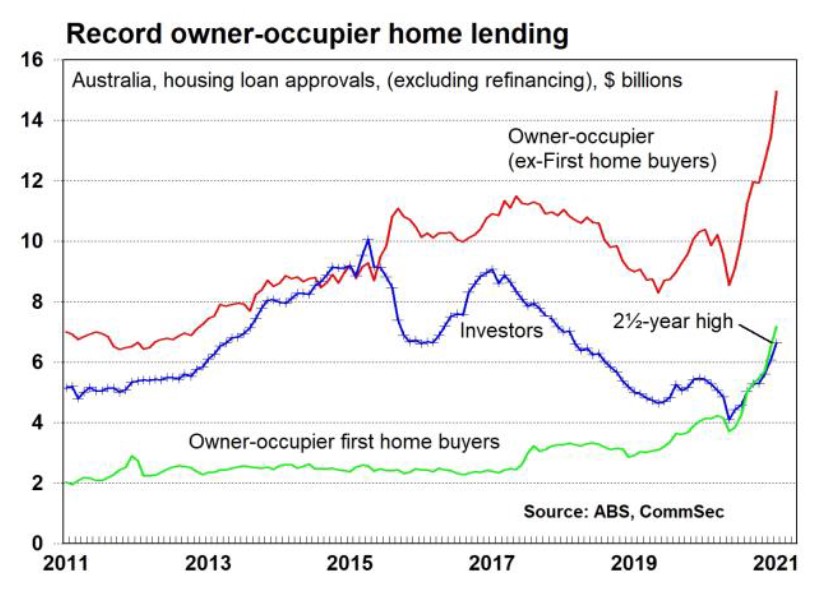

Also, here in another graph below, this graph shows something the market hasn’t seen for some time, which is the same strong activity across all of the three main buyer types, you’ll see in the graph below that all three, the investors, the first home buyers and already owner-occupiers and they all have spiked from late 2019, which clearly shows why there is so much competition in today’s market and particularly at auctions.

Here are the news edits making the headlines this week:

- ANZ reported job advertisements rose by 7.2 per cent in February presenting a 28-month high of 174,010 available positions. Job ads are now up 13.4 per cent from a year ago.

- Home loans: The value of new home loan commitments rose by 10.5 per cent in January to a record high of $28.75 billion. Owner-occupier loans were up 10.9 per cent and investor loans were up by 9.4 per cent – the most in 4 years – to a 2½-year high of $6.64 billion.

- Melbourne Institute inflation gauge: The headline measure rose 0.1 per cent in February to be up 1.6 per cent a year ago. The trimmed mean gauge rose 0.1 per cent to be up just 0.3per cent a year ago.

- Afterpay reported its half years results from this week with an 89 per cent increase in its revenue, however, it reported a half-year loss of $79.2 million. The share price as of Monday this week had risen $117 a share or 1468% since its low in March 2020.

The Numbers

And lastly. the numbers across OBrien for the week proved strong. We sold 15 of out 15schedule auctions last weekend which was of course a 100% clearance rate. Over the week, listing numbers bounced back 113 new listings launching onto the market, we had 101 properties come under contract with 97 confirmed sales and a top price of 2.08 Million.

OBrien Real Estate Links

Featured Property Listings

Upcoming Auctions

Recently Sold Properties

That’s all for this week, I’m Dean OBrien and remember the information provided is of a general nature you should always seek independent legal, financial, taxation or other advice in relation to your unique circumstances.