Buying A Home First or Selling A Home First?

People change homes throughout their life for a number of reasons. It could be as simple as a change for change sakes, career shift, the need for more space and room, the breakup of marriage or partnership. There are a whole host of reasons. But the question is if you are deciding to change homes and relocate to a new home should you sell before you buy or buy your new property before you sell?

However, when you start your hunt for that new home that hopefully is an upgrade to a better place you should create yourself a plan. The first and obvious question is do you sell your current home first or do you buy your new home first?

Begin with the real estate market you intend to enter into?

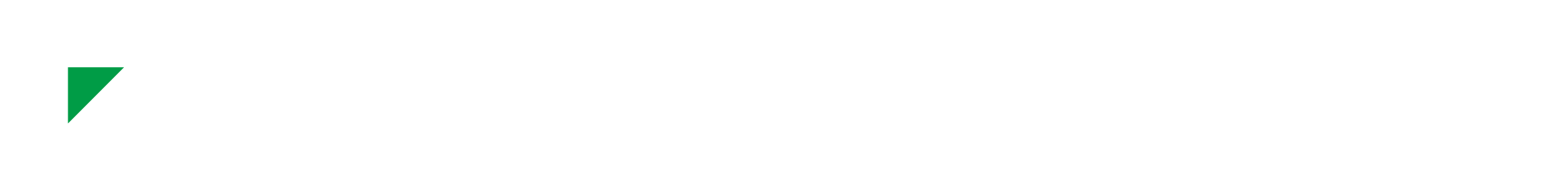

Different suburbs and states have different prices for a multitude of reasons. So, contact a local real estate agent in your intended location should be your first step. Ask as many questions that you have prepared on your checklist. Do research on property advice portals that produce suburb property data Here you can find property trends that can help you leverage your position.

If you find that your home is in a buyers market it may make sense to sell your home first. This is probably the best scenario as you don’t want to purchase your new home first then find you cannot sell your existing home due to lack of interest. This can also add stress to your shift and cost you money on bridging finance which could become costly.

However, in a seller’s market, purchasing first could be the other option for you, as there should be more buyers than there are properties on the market and your current home is more likely to sell quicker.

Not all markets are the same. Where you currently live could be a seller’s market and where you intend to buy could be a buyers market. So it is imperative you do your research and find the solution that fits you best.

Selling Your Home First

Naturally selling your home first is the option most people consider favourable. It has the least risk attached and is a bit of a safer option. But this option can come with a fair amount of inconvenience.

The Pros of Selling Your Home First

- When you sell first you will know the exact of money you have after all the fees have been dispersed. You will be able to understand if and how much you may need to borrow for your new home.

- You will save money on having to pay for 2 loans at the same time or paying for bridging finance.

- Let’s say your current home doesn’t sell as fast as you anticipated. This could lead to you taking lower offers on your property.

- You should negotiate a longer 90-day settlement and thus extending the time you have when trying to find a new property. It is also possible for the buyers and sellers to have a 6-month or longer settlement. This is worth exploring because the potential buyers may be in the same predicament.

The Cons of Selling Your Home First

- If you sold your home first and haven’t found your new home then you will need to find accommodation. If you have to rent then this will be an added expense and inconvenience.

- You will be moving twice if there is a gap between the sale and purchase of your new home. You may find lodgings with a friend or family but you will still need to store your furnishings and goods.

- If house prices are on the increase and there is a delay in purchasing the new home you take the chance of being priced out of the market and having to settle for less than you anticipated.

Buying Your Home First

This is potentially a riskier strategy, but also offers the advantages of giving you a better opportunity to find your ideal home and can work well in a seller’s market.

The Pros of Buying Your Home First

- You may have found your dream home and do not want to miss out on purchasing it. So, depending on your financial situation this could be the best way to go.

- If you do buy first then you will know the exact day you can move in. This is probably the least stressful scenario as you already have your new address and you are the owner. And of course, you only have to move one time.

- If house prices are rising quickly, you could potentially get a bargain on your next home, while letting the market upswing add to the value of your current home.

The Cons of Buying Your Home First

- The balancing act of buying first comes with its dangers. What if you have overestimated the sale price of your current home? You could find yourself in a financial mess on the settlement of your new house.

- Holding a mortgage on your current home means you will have to mortgage payments to make. Or, carry the expense of bridging finance which is not cheap. If you have a mortgage on your current home, you will have to juggle two loans or take out costly bridging finance.

- Your home could take longer to sell if the market begins to slow down. This means you may be in a situation where you have to sell your home for less than you wanted.

Talk to a Home Loan Specialist

Before you make your decision talk to a home lending expert. Ask them about all the options that are open to you and present scenarios that could unfold and leave you in an unfavourable position. This will help you better understand all the hidden costs and unexpected fees you may not have thought of.