Income Tax Cuts From 1 July 2024 to help with “Cost of Living”

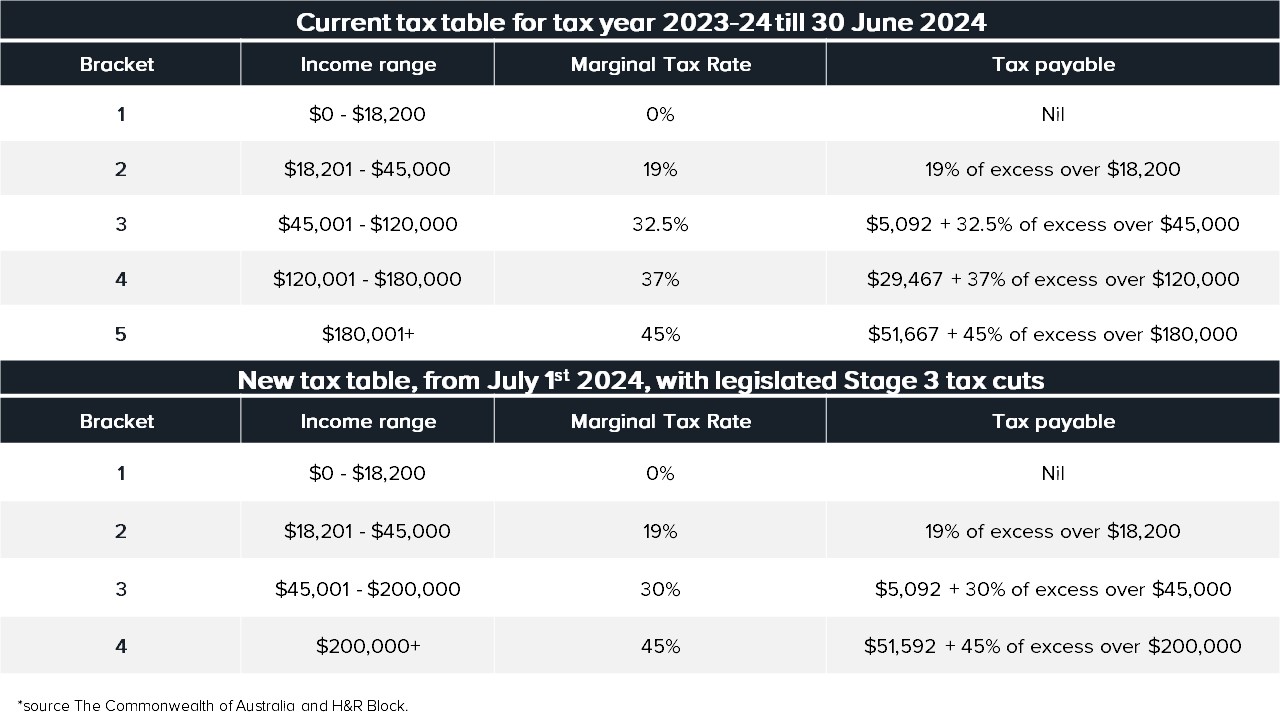

The redesigned Stage 3 income tax cuts will come into effect on July 1, 2024, after the Senate passed the revised legislation to cut the tax through the Senate earlier this year, on 25 January. The changes include changes to the income ranges and tax rates in the marginal tax brackets, which means that the tax savings have been distributed much more widely. The new revision now focuses on the low and middle-income taxpayers, who have been suffering the most from increases in the cost of living.

Here is how the tax cuts will ease the burden. A person earning $45,000 will save $804, whereas person earning a $80,000 will save $1,679, a person earning $120,000 saves $2,679 and a person earning 180,000 saves $3729.

• A cut in the 19% tax rate to 16% from $18,201 to $45,000

• A cut in the 32.5% rate to 30% for incomes between $45,001 and $135,000

• Retaining the 37 per cent rate but increasing the threshold for it to apply to $135,000.

• Retaining the current 45% tax rate but increasing the threshold to $190,000 ($10,000 less than in the original design)