Don’t group Victoria with the rest of the Australian housing market.

There is a rock band called the “Living End” and they wrote a song called “White Noise”, I often sing the chorus of that song to myself when I hear another headline about inflation, increased rates, or the cost of living. The rational optimism in me says that generally, we as a nation are all collectively getting healthier, wealthier, and happier without us even knowing it.

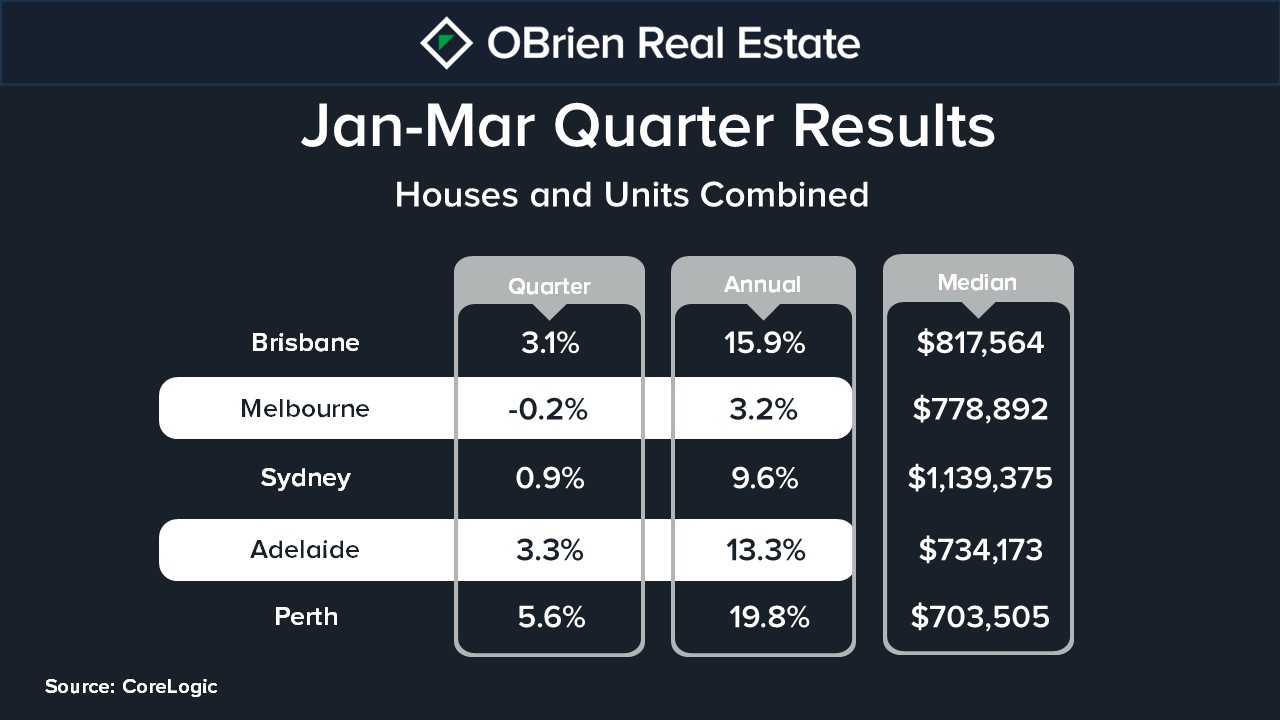

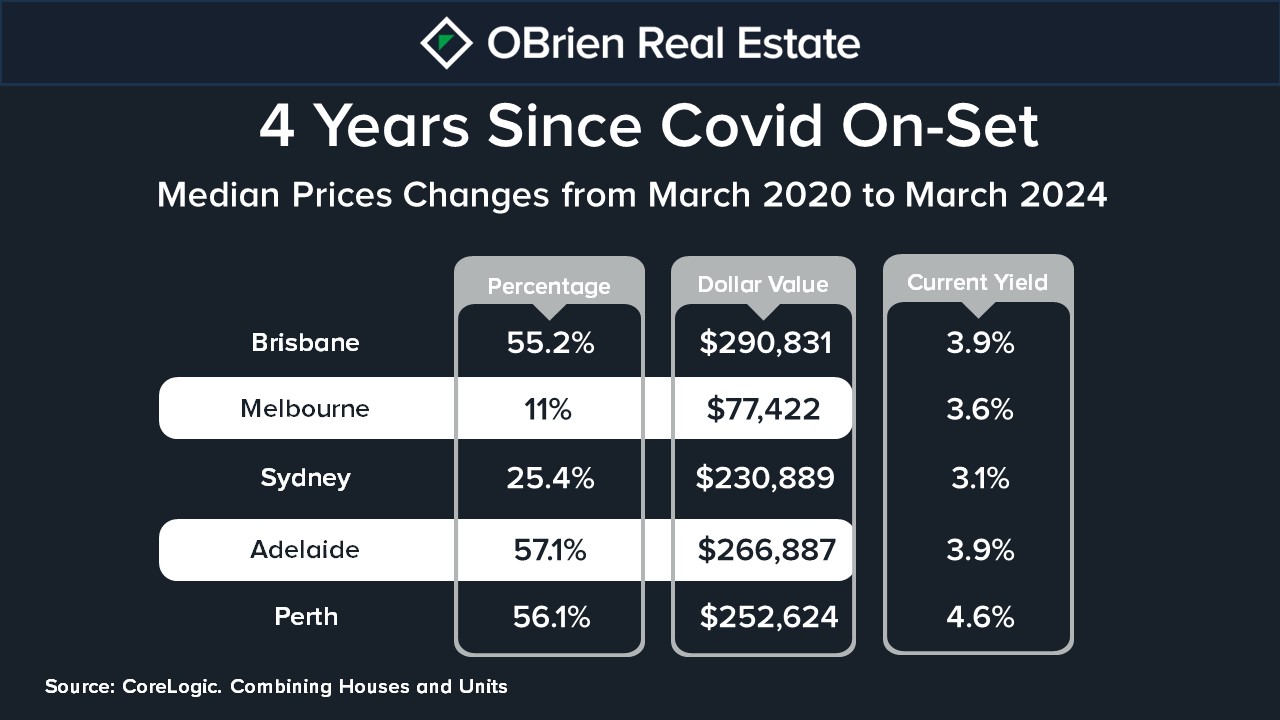

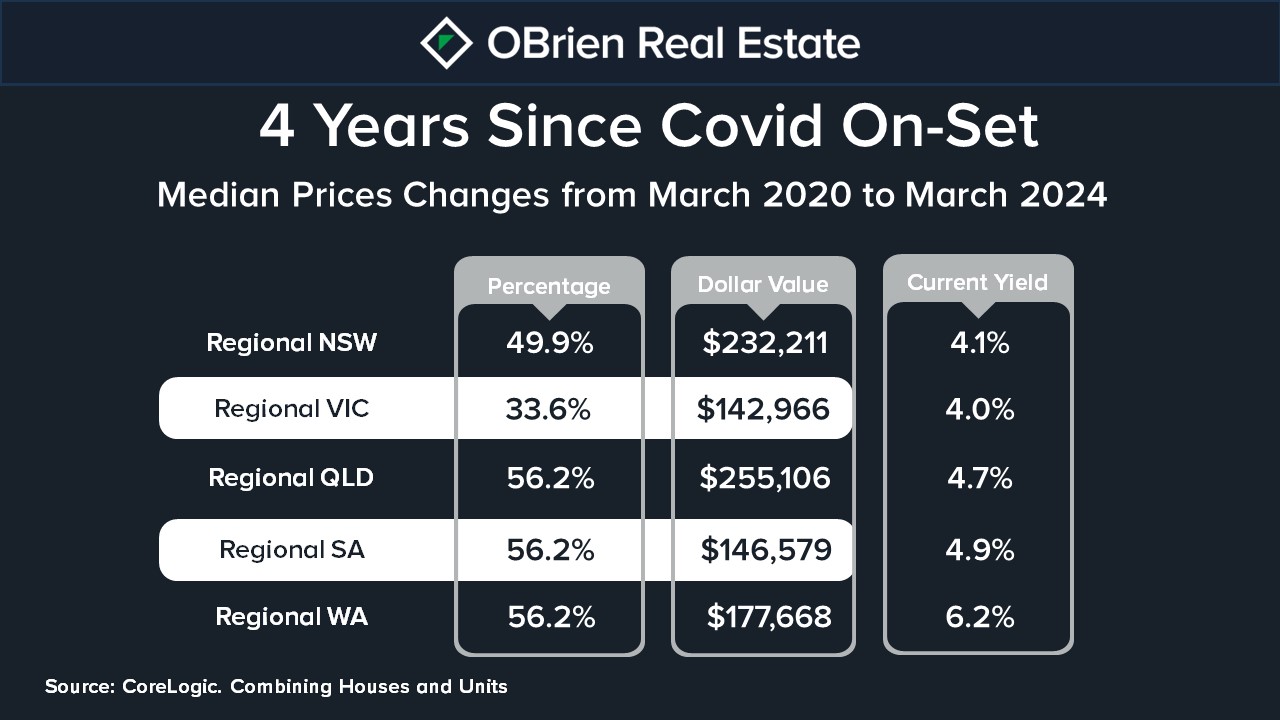

The quarter for Victoria and Melbourne was quite a different story than any of the other four major capital cities, and it’s been like this for some time now; in fact, it’s been like this for 4 years, ever since the on-set of COVID in March 2020. Victoria and Melbourne have been limping behind the other 4 major states in relation to both property price growth and rental growth.

The main real estate news now is centred around the talk on whether inflation is dropping fast enough and if it isn’t will it a mean a delay to the speculated interest rate cut in September. The March quarter in fact saw inflation drop from 4.1% in the previous quarter to record 3.6% this quarter, and this is the fifth consecutive quarter we have seen a fall since the inflation rate peaked at 7.8 per cent in the December 2022 quarter, only 15 months ago.

The contributing reasons for a 3.6% inflation rate come from insurance premiums rising 16.4 per cent, the strongest rise since 2001 as many insurers have lifted premiums due to extreme weather events. Education was the second most significant contributor after increasing by 5.9 per cent, followed by a 2.8 per cent uplift in health and a 0.7 per cent lift in housing. The good news is that at least two of the four most contributing factors to inflation over the March quarter will fall out of the June quarter’s CPI.

The Reserve Bank meets on 7 May, and because of the downward pressure on inflation, they are very much expected to hold rates. Economists expect interest rates to remain higher for longer, with Westpac now shifting its forecast for an expected cut from September to November 2024, bringing it into line with ANZ and the National Australia Bank. That leaves the Commonwealth Bank as the only bank in the Big 4 that is expecting a September interest rate cut.

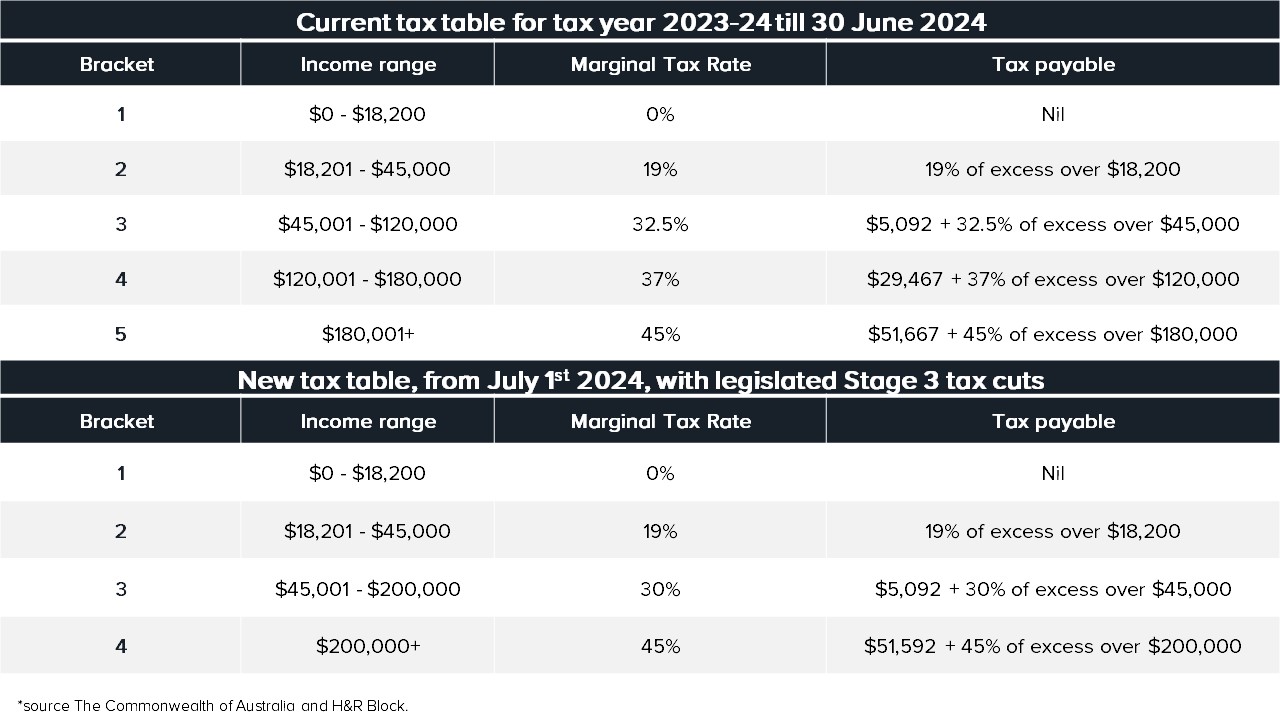

The Federal Budget gets delivered on 14 May, and we would expect some stimulus towards assisting with the cost-of-living pressures pensioners, families and households. One stimulus that is already confirmed is the income tax cuts from 1 July 2024. The redesigned Stage 3 income tax cuts mean that the tax savings have been distributed much more widely to all tax brackets, with the new revision now focusing on the low and middle-income taxpayers.

Here’s how the tax cuts will ease the burden. A person earning $45,000 will save $804, whereas person earning a $80,000 will save $1,679, a person earning $120,000 saves $2,679 and a person earning 180,000 saves $3729.

Here’s all the changes below: